Technological Advancements in Photonic Devices

The US Electro Optic Modulators Market is poised for growth due to ongoing technological advancements in photonic devices. Innovations in materials and fabrication techniques are enhancing the performance and efficiency of electro optic modulators, making them more attractive for various applications. For instance, the development of lithium niobate and polymer-based modulators has led to improved bandwidth and lower power consumption. The market is expected to benefit from these advancements, as industries increasingly adopt electro optic modulators for applications in telecommunications, data centers, and medical imaging. Furthermore, the integration of electro optic modulators with other photonic components is likely to create new opportunities for growth within the US Electro Optic Modulators Market, as systems become more compact and efficient.

Expansion of Defense and Aerospace Applications

The US Electro Optic Modulators Market is significantly influenced by the expansion of defense and aerospace applications. The increasing investment in military technologies, particularly in areas such as laser communication and remote sensing, has created a heightened demand for electro optic modulators. These devices are essential for modulating laser signals in various defense systems, including missile guidance and surveillance. According to recent reports, the US defense budget allocates a substantial portion to research and development in advanced optical technologies, which is expected to bolster the market for electro optic modulators. As the defense sector continues to innovate, the demand for high-performance modulators is likely to increase, positioning the US Electro Optic Modulators Market for sustained growth in the coming years.

Growing Demand for High-Speed Data Transmission

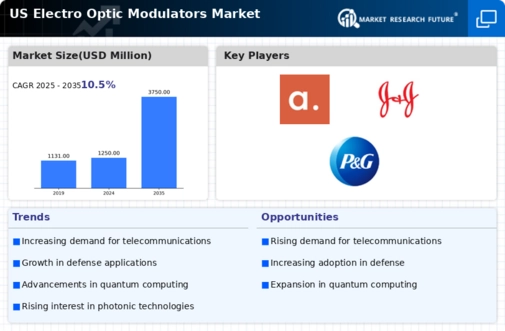

The US Electro Optic Modulators Market is experiencing a surge in demand for high-speed data transmission, primarily driven by the increasing reliance on broadband connectivity. As the need for faster internet speeds escalates, electro optic modulators play a crucial role in enabling high-capacity optical communication systems. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years, reflecting the critical role these devices play in telecommunications infrastructure. Furthermore, advancements in fiber optic technology are likely to enhance the performance of electro optic modulators, thereby expanding their application in data centers and long-haul communication networks. This trend indicates a robust future for the US Electro Optic Modulators Market, as industries seek to upgrade their communication systems to meet the demands of an increasingly digital world.

Increasing Adoption in Medical Imaging Technologies

The US Electro Optic Modulators Market is witnessing an increase in adoption within medical imaging technologies. As healthcare providers seek to enhance diagnostic capabilities, electro optic modulators are becoming integral to advanced imaging systems such as optical coherence tomography (OCT) and laser-based imaging techniques. The growing emphasis on non-invasive diagnostic methods is driving the demand for high-performance modulators that can provide precise control over light signals. Market analysts project that the medical sector will account for a significant share of the electro optic modulators market, with a growth rate of around 8% over the next few years. This trend underscores the importance of electro optic modulators in improving patient outcomes and advancing medical technology in the US.

Regulatory Support for Optical Communication Technologies

The US Electro Optic Modulators Market benefits from regulatory support aimed at promoting optical communication technologies. Government initiatives and policies that encourage the development of high-speed internet infrastructure are likely to drive demand for electro optic modulators. For instance, the Federal Communications Commission (FCC) has implemented programs to expand broadband access, which inherently increases the need for efficient optical communication systems. This regulatory environment fosters innovation and investment in the electro optic modulators market, as companies seek to align their products with government standards and initiatives. As a result, the US Electro Optic Modulators Market is expected to experience growth, driven by both public and private sector investments in optical technologies.