Advancements in Genetic Testing

Advancements in genetic testing technologies are transforming the landscape of the fabry disease market. The ability to conduct comprehensive genetic screenings has improved the accuracy of diagnoses, allowing for earlier intervention and management of the disease. As testing becomes more accessible and affordable, it is anticipated that more individuals will be screened for Fabry disease, leading to an increase in diagnosed cases. This trend not only enhances patient outcomes but also drives demand for treatment options tailored to the specific genetic profiles of patients. The integration of genetic testing into routine clinical practice is likely to play a pivotal role in shaping the future of the fabry disease market, as it enables personalized medicine approaches that cater to individual patient needs.

Increased Healthcare Expenditure

The rising healthcare expenditure in the US is a significant driver impacting the fabry disease market. With healthcare spending projected to reach approximately $6 trillion by 2027, there is a growing allocation of resources towards the treatment of rare diseases, including Fabry disease. This increase in funding allows for better access to advanced therapies and diagnostic tools, which are essential for managing the disease effectively. Furthermore, as insurance coverage expands and reimbursement policies evolve, patients are likely to have improved access to necessary treatments. This trend suggests a favorable environment for the fabry disease market, as more patients can afford and access innovative therapies that enhance their quality of life.

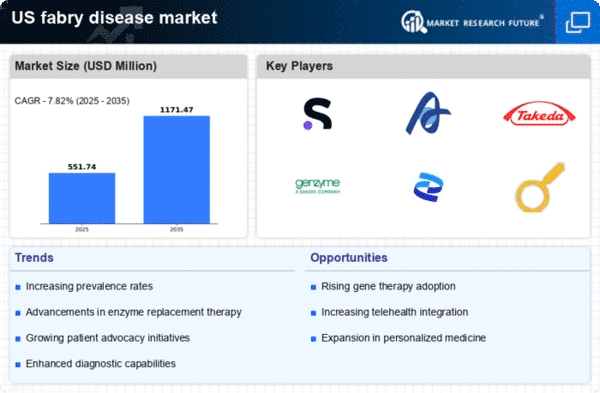

Rising Prevalence of Fabry Disease

The increasing prevalence of Fabry disease in the US is a critical driver for the fabry disease market. Recent estimates suggest that the condition affects approximately 1 in 40,000 to 1 in 117,000 individuals, leading to a growing patient population requiring treatment. This rise in cases is likely to stimulate demand for therapies and diagnostic tools, thereby expanding the market. As awareness of the disease increases among healthcare professionals and patients, more individuals are being diagnosed, which further contributes to the market's growth. The need for effective management of symptoms and complications associated with Fabry disease is becoming more pronounced, indicating a robust market potential for pharmaceutical companies and healthcare providers involved in the fabry disease market.

Innovative Research and Development

Ongoing research and development efforts in the field of rare diseases, particularly Fabry disease, are propelling the fabry disease market forward. Pharmaceutical companies are investing heavily in the development of novel therapies, including gene therapies and enzyme replacement therapies, which have shown promise in clinical trials. The US market has seen a surge in funding for research initiatives, with investments reaching millions of dollars annually. This focus on innovation is likely to yield new treatment options that could significantly improve patient outcomes. As these therapies receive regulatory approval, they are expected to enhance the competitive landscape of the fabry disease market, attracting more stakeholders and increasing market share for companies that successfully bring new products to market.

Growing Patient Advocacy and Support Groups

The emergence of patient advocacy and support groups is significantly influencing the fabry disease market. These organizations play a crucial role in raising awareness about Fabry disease, providing education, and advocating for better access to treatments. Their efforts have led to increased visibility of the disease, which may result in more individuals seeking diagnosis and treatment. Additionally, these groups often collaborate with pharmaceutical companies and healthcare providers to facilitate clinical trials and research initiatives. As patient advocacy continues to grow, it is likely to foster a more supportive environment for patients and their families, ultimately driving demand for therapies and services within the fabry disease market.