Health and Wellness Trends

The growing emphasis on health and wellness among pet owners is a notable driver for the pet packaging market. Consumers are increasingly seeking high-quality, nutritious pet food options, which often require specialized packaging to maintain freshness and integrity. Reports indicate that the premium pet food segment has seen a growth rate of approximately 20% annually, as pet owners prioritize their pets' health. This shift necessitates packaging solutions that not only preserve product quality but also communicate health benefits effectively. As a result, the pet packaging market is likely to witness an uptick in demand for packaging that aligns with these health-conscious trends.

Rising Pet Ownership Rates

The increasing trend of pet ownership in the US appears to be a primary driver for the pet packaging market. As more households welcome pets, the demand for pet-related products, including food and accessories, surges. Recent statistics indicate that approximately 70% of US households own a pet, which translates to over 90 million pet dogs and 94 million pet cats. This growing pet population necessitates innovative packaging solutions that cater to diverse consumer preferences. Consequently, manufacturers in the pet packaging market are likely to focus on developing packaging that is not only functional but also appealing to pet owners. This trend may lead to an expansion in product offerings, thereby stimulating market growth.

Sustainability Initiatives

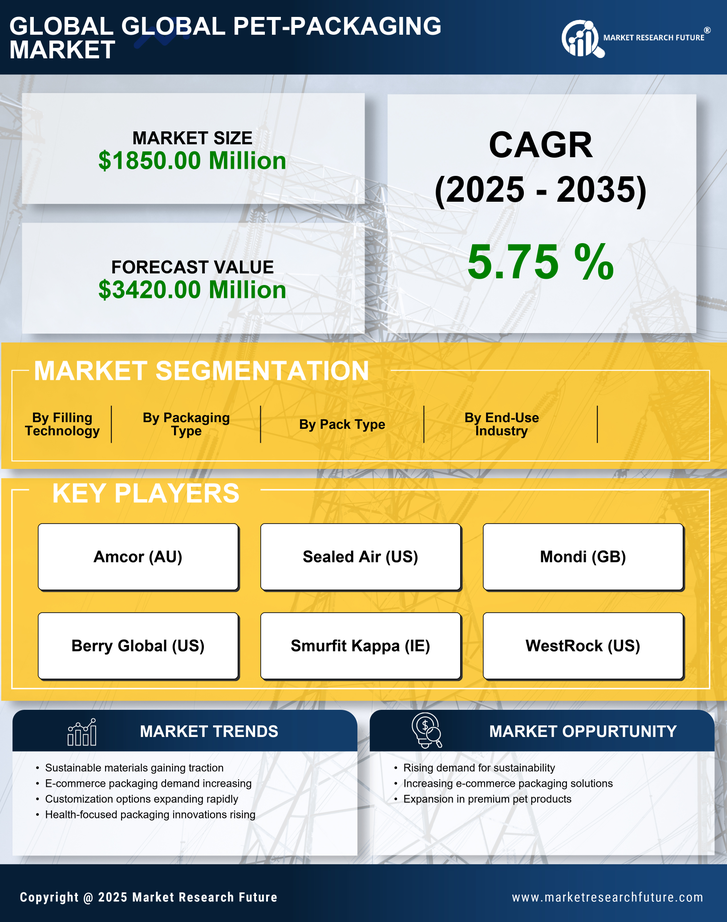

Sustainability initiatives are becoming increasingly relevant in the pet packaging market. As consumers grow more environmentally conscious, there is a rising demand for eco-friendly packaging solutions. Many pet owners are now actively seeking products that utilize sustainable materials, which has prompted manufacturers to explore biodegradable and recyclable packaging options. Recent surveys indicate that nearly 60% of pet owners prefer brands that demonstrate a commitment to sustainability. This shift in consumer preference is likely to drive innovation in packaging design and materials, pushing the US pet packaging market towards more sustainable practices.

E-commerce Growth in Pet Products

The rapid expansion of e-commerce platforms in the pet products sector significantly influences the pet packaging market. With more consumers opting to purchase pet supplies online, the demand for efficient and protective packaging solutions has intensified. Data suggests that online sales of pet products have increased by over 30% in recent years, reflecting a shift in consumer purchasing behavior. This trend compels packaging manufacturers to innovate and create packaging that ensures product safety during transit while also being visually appealing. As e-commerce continues to thrive, the global pet-packaging market is expected to adapt to these changing dynamics, focusing on packaging that enhances the online shopping experience.

Regulatory Compliance and Safety Standards

The pet packaging market in US is significantly influenced by the need for compliance with regulatory standards and safety protocols. In the US, packaging for pet products must adhere to stringent guidelines set forth by organizations such as the FDA and USDA. These regulations ensure that packaging materials are safe for both pets and the environment. As awareness of these regulations increases, manufacturers are compelled to invest in compliant packaging solutions that meet safety standards. This focus on regulatory compliance not only enhances consumer trust but also drives innovation within the global pet-packaging market, as companies seek to differentiate themselves through quality and safety.