Growing Focus on Energy Security

Energy security remains a pivotal concern for the hvdc converter-station market. With increasing geopolitical tensions and the need for a stable energy supply, the US is focusing on diversifying its energy sources and enhancing grid resilience. HVDC technology facilitates the interconnection of different power grids, allowing for better management of energy resources and reducing dependency on a single source. This strategic approach not only bolsters energy security but also promotes the integration of renewable energy sources. As a result, the hvdc converter-station market is poised for growth, as stakeholders recognize the importance of a robust and secure energy infrastructure.

Technological Advancements in HVDC Systems

Technological advancements are significantly influencing the hvdc converter-station market. Innovations in power electronics, control systems, and converter designs are enhancing the efficiency and reliability of HVDC systems. For example, the development of modular multilevel converters (MMCs) has improved the performance of HVDC stations, allowing for better scalability and flexibility in power transmission. These advancements not only reduce operational costs but also increase the attractiveness of HVDC solutions for utility companies. As the US continues to prioritize modernization of its energy infrastructure, the hvdc converter-station market is likely to benefit from these technological improvements, fostering a more resilient and efficient power grid.

Rising Demand for Efficient Power Transmission

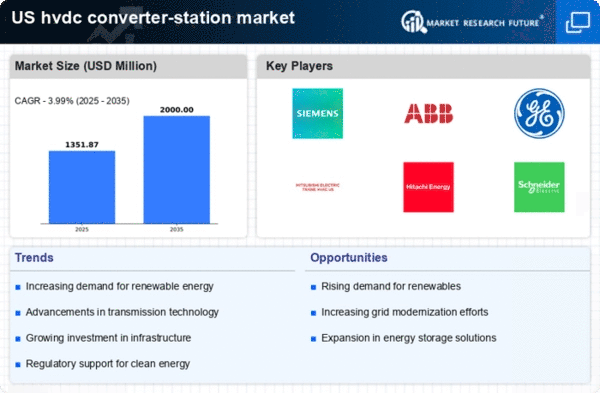

The hvdc converter-station market is experiencing a surge in demand driven by the need for efficient power transmission systems. As urbanization and industrialization continue to escalate, the demand for reliable and high-capacity power transmission solutions becomes paramount. HVDC technology offers advantages such as reduced transmission losses and the ability to transmit power over long distances with minimal environmental impact. In the US, the market is projected to grow at a CAGR of approximately 8% from 2025 to 2030, reflecting the increasing investments in infrastructure to support renewable energy integration. This trend indicates a robust future for the hvdc converter-station market, as utilities and energy providers seek to enhance grid reliability and efficiency.

Government Incentives for Clean Energy Projects

Government incentives play a crucial role in shaping the hvdc converter-station market. Various federal and state programs are designed to promote clean energy initiatives, which often include the deployment of HVDC technology. These incentives may take the form of tax credits, grants, or subsidies aimed at reducing the financial burden on energy companies investing in modern infrastructure. For instance, the US government has allocated billions of dollars to support renewable energy projects, which indirectly boosts the hvdc converter-station market. As these incentives continue to evolve, they are likely to stimulate further investment in HVDC systems, thereby enhancing the overall market landscape.

Increased Investment in Renewable Energy Integration

The hvdc converter-station market is significantly influenced by the increased investment in renewable energy integration. As the US transitions towards a more sustainable energy landscape, there is a growing emphasis on harnessing wind, solar, and other renewable sources. HVDC technology is particularly well-suited for this purpose, as it enables the efficient transmission of power generated from remote renewable sites to urban centers. Recent reports indicate that investments in renewable energy projects are expected to exceed $100 billion by 2030, further driving the demand for hvdc converter stations. This trend underscores the critical role of HVDC systems in facilitating the transition to a cleaner energy future.