Emergence of Smart Grid Technologies

The hvdc capacitor market is poised for growth due to the emergence of smart grid technologies in the United States. These technologies aim to enhance the efficiency and reliability of electricity distribution, necessitating the use of advanced components such as capacitors. Smart grids leverage real-time data and automation to optimize energy flow, which requires robust power management solutions. The market for smart grid technologies is projected to reach approximately $100 billion by 2026, indicating a strong demand for hvdc capacitors as integral components of these systems. As utilities and energy providers invest in smart grid infrastructure, the hvdc capacitor market is likely to benefit from increased adoption and integration of these innovative technologies.

Focus on Grid Modernization Initiatives

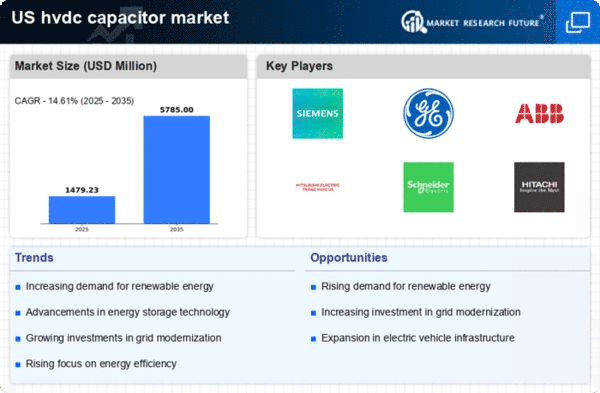

The hvdc capacitor market is influenced by ongoing grid modernization initiatives in the United States. As aging infrastructure poses challenges to energy distribution, there is a concerted effort to upgrade and enhance grid capabilities. These modernization efforts often involve the implementation of hvdc technology, which requires advanced capacitors to ensure optimal performance. The US Department of Energy has allocated significant funding for grid modernization projects, with estimates suggesting an investment of over $20 billion in the next five years. This focus on modernization is expected to drive demand for hvdc capacitors, as utilities seek to improve grid resilience and accommodate the growing integration of renewable energy sources. Consequently, the hvdc capacitor market is likely to thrive as these initiatives progress.

Increasing Investment in Infrastructure

The hvdc capacitor market is experiencing a surge in investment aimed at modernizing and expanding electrical infrastructure across the United States. This trend is driven by the need to enhance grid reliability and efficiency, particularly as the demand for electricity continues to rise. According to recent data, investments in electrical infrastructure are projected to reach approximately $100 billion by 2027. This influx of capital is likely to bolster the hvdc capacitor market, as these components are essential for managing power flow and maintaining system stability. Furthermore, the integration of hvdc technology into existing grids necessitates the deployment of advanced capacitors, thereby creating a favorable environment for market growth. As utilities and private investors prioritize infrastructure upgrades, the hvdc capacitor market is poised to benefit significantly from these developments.

Rising Demand for Energy Storage Solutions

The hvdc capacitor market is being propelled by the increasing demand for energy storage solutions in the United States. As renewable energy sources, such as solar and wind, become more prevalent, the need for efficient energy storage systems is paramount. Capacitors play a crucial role in energy storage applications, providing rapid discharge capabilities and enhancing overall system performance. The energy storage market is expected to grow at a CAGR of over 20% through 2030, indicating a robust demand for hvdc capacitors. This growth is further supported by advancements in battery technologies and the integration of smart grid solutions, which require reliable and efficient capacitors to optimize energy flow. Consequently, the hvdc capacitor market is likely to see increased adoption as energy storage solutions become integral to the evolving energy landscape.

Expansion of Electric Vehicle Infrastructure

The hvdc capacitor market is benefiting from the rapid expansion of electric vehicle (EV) infrastructure across the United States. As the government and private sector invest heavily in EV charging stations, the demand for efficient power management solutions is on the rise. Capacitors are essential in these applications, as they help stabilize voltage and improve the efficiency of charging systems. The EV market is projected to grow significantly, with estimates suggesting that by 2030, EV sales could account for over 30% of total vehicle sales in the US. This shift towards electrification necessitates the integration of hvdc technology, which relies on capacitors for effective operation. As a result, the hvdc capacitor market is likely to experience substantial growth driven by the increasing need for reliable and efficient charging infrastructure.

.png)