Market Growth Projections

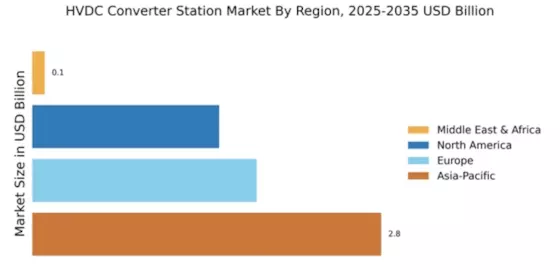

The Global HVDC Converter Station Market Industry is projected to experience substantial growth over the coming years. With a market value of 6.1 USD Billion in 2024, it is anticipated to reach 9.36 USD Billion by 2035. This growth reflects a compound annual growth rate (CAGR) of 3.97% from 2025 to 2035, indicating a steady increase in demand for HVDC technology. Factors contributing to this growth include the rising need for efficient power transmission, the expansion of renewable energy sources, and supportive government policies. These projections highlight the market's potential and the critical role of HVDC systems in future energy infrastructure.

Government Initiatives and Policies

Government initiatives play a pivotal role in shaping the Global HVDC Converter Station Market Industry. Various nations are implementing policies that promote the adoption of HVDC technology as part of their energy transition strategies. For instance, incentives for renewable energy projects and funding for grid modernization are becoming increasingly common. These policies not only enhance the feasibility of HVDC projects but also stimulate investments in the sector. As a result, the market is expected to grow at a CAGR of 3.97% from 2025 to 2035, reflecting the positive impact of supportive regulatory frameworks on the industry.

Increasing Demand for Renewable Energy

The Global HVDC Converter Station Market Industry is experiencing a notable surge in demand driven by the transition towards renewable energy sources. As countries strive to meet their carbon reduction targets, the integration of wind and solar power into the grid becomes imperative. HVDC technology facilitates the efficient transmission of electricity over long distances, making it essential for connecting remote renewable energy sites to urban centers. This trend is reflected in the projected market value, which is anticipated to reach 6.1 USD Billion in 2024, indicating a robust growth trajectory as investments in renewable infrastructure continue to escalate.

Integration of Smart Grid Technologies

The integration of smart grid technologies is emerging as a key driver for the Global HVDC Converter Station Market Industry. Smart grids enable better management of electricity supply and demand, enhancing the efficiency of power systems. HVDC technology complements smart grid initiatives by facilitating the integration of distributed energy resources and improving grid resilience. The synergy between HVDC systems and smart grid technologies is likely to attract significant investments, as utilities seek to modernize their infrastructure. This trend is expected to support the market's growth trajectory, aligning with the broader shift towards more intelligent and responsive energy systems.

Technological Advancements in HVDC Systems

Technological advancements are significantly influencing the Global HVDC Converter Station Market Industry. Innovations in converter technology, control systems, and materials are enhancing the efficiency and reliability of HVDC systems. For example, developments in voltage source converter technology allow for more flexible and controllable power flow, which is crucial for modern power grids. These advancements not only improve operational performance but also reduce costs associated with HVDC installations. As a result, the market is poised for growth, with projections indicating a value of 9.36 USD Billion by 2035, underscoring the importance of continuous innovation in the sector.

Rising Urbanization and Electrification Needs

The Global HVDC Converter Station Market Industry is also driven by rising urbanization and the corresponding electrification needs. As urban populations expand, the demand for reliable and efficient power supply increases. HVDC technology offers a solution by enabling the transmission of large amounts of electricity over long distances with minimal losses. This capability is particularly vital for urban areas that require stable and uninterrupted power supply. The ongoing urbanization trends are expected to further fuel investments in HVDC infrastructure, thereby contributing to the overall market growth and enhancing energy security in densely populated regions.