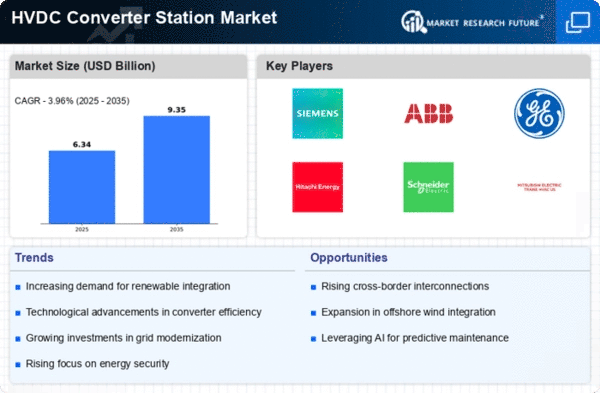

Top Industry Leaders in the HVDC Converter Station Market

*Disclaimer: List of key companies in no particular order

The HVDC converter station market is rife with high-stakes competition as companies strive to dominate a crucial element in the energy transmission landscape. These stations play a vital role in converting electricity between AC and DC, facilitating efficient long-distance transmission and integrating renewable energy sources. Let's navigate through the intricate terrain of this dynamic market, examining key strategies of players, pivotal factors, and emerging trends shaping the future of HVDC.

Strategic Approaches by Key Players:

Product Diversification: Leaders like ABB and Siemens are diversifying beyond traditional Line Commutated Converters (LCCs) by developing modular Voltage Source Converters (VSCs). VSCs offer superior controllability and grid integration, addressing the escalating demands for renewable energy and intricate grid requisites.

Technological Advancements: Innovation propels this market forward. Start-ups like GridBeyond disrupt the field with AI-powered optimization systems for converter stations, enhancing efficiency and grid stability. This technological edge appeals to forward-thinking grid operators and early adopters.

Strategic Collaborations: Acknowledging the complexities of constructing and integrating HVDC systems, major players like Hitachi ABB Power Grids forge strategic partnerships with engineering firms and renewable energy developers. These collaborations expedite project execution and harness specialized expertise.

Geographical Focus and Compliance: Market dynamics and regulations differ vastly across regions. GE Grid Solutions caters to North America's demand for advanced features with their digital twins of converter stations. In contrast, State Grid Corporation of China concentrates on domestic projects due to stringent technical and environmental regulations.

Factors Influencing Market Share:

Efficiency and Energy Loss: Minimizing energy loss during conversion is pivotal. Players like Emerson Electric, with their high-efficiency valves and converter topologies, stand out, offering cost savings to grid operators and reducing overall environmental impact.

Reliability and Grid Stability: HVDC systems must operate reliably for prolonged periods. Companies like Mitsubishi Electric prioritize robust designs and stringent quality control measures to instill trust among grid operators and ensure seamless power transmission.

Scalability and Adaptability: Grid requirements vary significantly. BHEL offers modular VSC designs that can be scaled to meet specific transmission needs, providing flexibility and cost-effectiveness to diverse projects.

Sustainability and Renewable Integration: Environmental consciousness is gaining momentum. ABB pioneers HVDC solutions for integrating offshore wind farms and large-scale solar projects, contributing to the global shift towards renewable energy.

Emerging Trends:

Multi-level Converters: Advanced designs offer even higher efficiency and enhanced controllability compared to traditional converters. Start-ups like Converteam lead in this technology, potentially revolutionizing long-distance power transmission.

Hybrid HVDC Systems: Strategic configurations combining LCCs and VSCs optimize cost, efficiency, and grid stability for specific applications. Companies like Siemens Energy are exploring hybrid solutions, offering tailored approaches to diverse transmission challenges.

Smart Grid Integration and Virtual Power Plants: Integrating HVDC converter stations with smart grid technologies and distributed renewable energy sources enables flexible and resilient power grids. GE Grid Solutions focuses on developing intelligent control systems for HVDC stations, optimizing power flow and grid stability in a decentralized system.

Overall Competitive Scenario:

The HVDC converter station market is a dynamic and intricate space driven by technological progress, evolving grid requirements, and the integration of renewable energy sources. Established players with comprehensive product portfolios, technological prowess, and global presence have an advantage. However, the emergence of new technologies, materials, and sustainability initiatives continually reshapes the landscape. Companies that swiftly adapt, innovate, develop cost-effective and efficient solutions tailored to specific grid needs, and contribute to a sustainable energy future will secure a high-voltage advantage in this competitive race.

Recent Industry Developments:

ABB Ltd. (Switzerland): Secured a €180 million order for ±450 kV HVDC converter station in Germany.

Bharat Heavy Electricals Ltd. (India): Commissioned India's first indigenously developed ±800 kV HVDC converter station.

Alstom (France): Successfully tested the world's first high-voltage hybrid circuit breaker for HVDC applications in collaboration with RTE.

Siemens AG (Germany): Successfully energized ±500 kV HVDC converter station in China.

Crompton Greaves Ltd. (India): Secured an order for ±800 kV HVDC converter station project in India.

General Electric (U.S.): Launched a new GridLink converter platform for HVDC applications and won a contract for ±500 kV HVDC converter station project in Brazil.

Nissin Electric Co Ltd (Japan): Collaborated with Hitachi ABB Power Grids on an HVDC converter station project in Japan.

Top Companies in the HVDC Converter Station industry include ABB Ltd. (Switzerland), Bharat Heavy Electricals Ltd. (India), Alstom (France), Siemens AG (Germany), Crompton Greaves Ltd. (India), General Electric (U.S.), Nissin Electric Co Ltd (Japan), Toshiba Corporation (Japan), Hitachi Ltd. (Japan), and others.