Enhanced Regulatory Frameworks

The medical implants market is shaped by evolving regulatory frameworks that aim to ensure the safety and efficacy of medical devices. In recent years, the FDA has implemented more stringent guidelines for the approval of new implants, which, while challenging for manufacturers, ultimately enhances patient safety. These regulations encourage innovation and quality improvements within the industry. As companies navigate these regulatory landscapes, the medical implants market is likely to see a rise in the development of safer, more effective products. This regulatory evolution not only protects patients but also fosters a competitive environment that drives technological advancements.

Increased Healthcare Expenditure

The medical implants market benefits from rising healthcare expenditure in the United States, which is projected to reach $4 trillion by 2025. This increase in spending is driven by a growing emphasis on advanced medical technologies and improved healthcare infrastructure. As hospitals and clinics invest in state-of-the-art equipment and procedures, the demand for high-quality medical implants rises correspondingly. This trend suggests that the medical implants market will continue to thrive, as healthcare providers seek to enhance patient care through the adoption of innovative implant solutions. The correlation between healthcare spending and market growth underscores the importance of financial investment in driving advancements in the field.

Growing Prevalence of Chronic Diseases

The medical implants market is significantly influenced by the rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and orthopedic conditions. As the population ages and lifestyle-related health issues become more common, the demand for implants that address these conditions increases. In 2025, it is estimated that chronic diseases will account for over 75% of healthcare costs in the US, further driving the need for effective medical implants. This trend indicates that the medical implants market must adapt to meet the growing demand for specialized implants that cater to the needs of patients with chronic health issues.

Technological Advancements in Implant Design

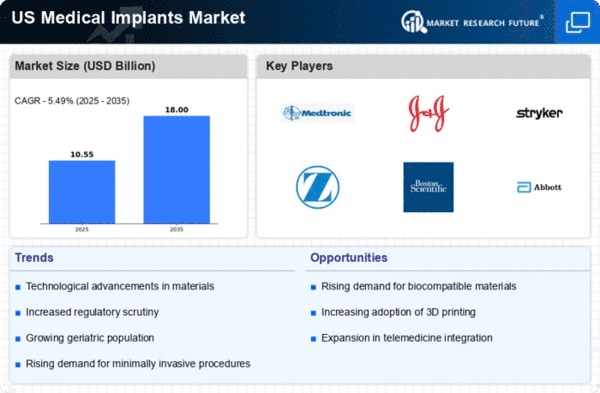

Innovations in materials science and engineering are propelling the medical implants market forward. The introduction of biocompatible materials and 3D printing technologies allows for the creation of customized implants tailored to individual patient needs. This customization enhances the effectiveness of implants, leading to improved patient satisfaction and outcomes. In 2025, the market is expected to grow at a CAGR of 7%, reflecting the increasing integration of technology in implant design. As these advancements continue to evolve, the medical implants market is poised for significant transformation, potentially leading to the development of smarter implants that can monitor patient health in real-time.

Rising Demand for Minimally Invasive Procedures

The medical implants market experiences a notable surge in demand for minimally invasive procedures, driven by patient preferences for reduced recovery times and lower surgical risks. As healthcare providers increasingly adopt advanced technologies, the market for implants that facilitate these procedures expands. In 2025, the market is projected to reach approximately $50 billion, with a significant portion attributed to innovations in implant design and materials. This trend indicates a shift towards less invasive surgical options, which not only enhance patient outcomes but also reduce overall healthcare costs. Consequently, the medical implants market is likely to witness sustained growth as more patients opt for these advanced solutions.