Growing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as diabetes, cardiovascular disorders, and neurological conditions is a key factor driving the microelectronic medical-implants market. As these conditions become more prevalent, the demand for innovative treatment solutions, including microelectronic implants, is expected to increase. For instance, the American Heart Association reports that cardiovascular diseases affect nearly 48% of adults in the US, creating a substantial market for cardiac implants. This trend suggests that the microelectronic medical-implants market will continue to expand as healthcare systems seek effective ways to manage chronic illnesses through advanced implant technologies.

Increased Investment in Healthcare R&D

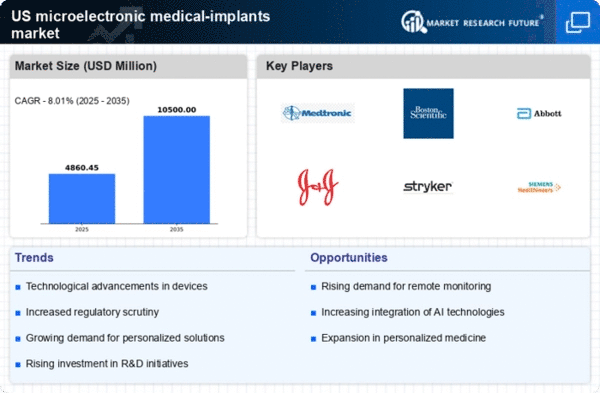

Investment in research and development (R&D) within the healthcare sector is a significant driver for the microelectronic medical-implants market. As companies allocate more resources to innovate and develop new products, the market is poised for expansion. Government funding and private sector investments are crucial in advancing technologies that enhance the efficacy and safety of medical implants. In recent years, R&D spending in the healthcare industry has risen by approximately 5% annually, indicating a robust commitment to innovation. This influx of capital is likely to lead to breakthroughs in microelectronic devices, further propelling market growth.

Technological Integration in Healthcare

The integration of advanced technologies such as artificial intelligence (AI) and machine learning into the microelectronic medical-implants market is transforming patient care. These technologies facilitate real-time monitoring and data analysis, enhancing the functionality of medical implants. For instance, AI algorithms can predict potential complications, allowing for timely interventions. The market is likely to benefit from this technological synergy, as healthcare providers increasingly adopt smart implants that offer improved diagnostics and treatment options. The potential for market growth is substantial, with projections indicating a valuation exceeding $20 billion by 2030, driven by these innovations.

Enhanced Patient Awareness and Education

Patient awareness regarding the benefits of microelectronic medical implants is on the rise, contributing to market growth. As individuals become more informed about their treatment options, they are more likely to advocate for advanced medical solutions. Educational initiatives by healthcare providers and organizations play a pivotal role in disseminating information about the advantages of microelectronic implants, such as improved quality of life and reduced hospital stays. This heightened awareness is likely to drive demand, as patients increasingly seek out these innovative solutions. Consequently, the microelectronic medical-implants market is expected to witness a steady increase in adoption rates.

Rising Demand for Minimally Invasive Procedures

The microelectronic medical-implants market experiences a notable surge in demand due to the increasing preference for minimally invasive surgical techniques. These procedures are associated with reduced recovery times, lower risk of complications, and enhanced patient comfort. As healthcare providers and patients alike seek alternatives to traditional surgeries, the market for microelectronic implants is projected to grow significantly. According to recent estimates, the market could expand at a CAGR of approximately 10% over the next five years. This trend indicates a shift in surgical practices, where microelectronic devices play a crucial role in improving patient outcomes and operational efficiency within healthcare settings.

.png)