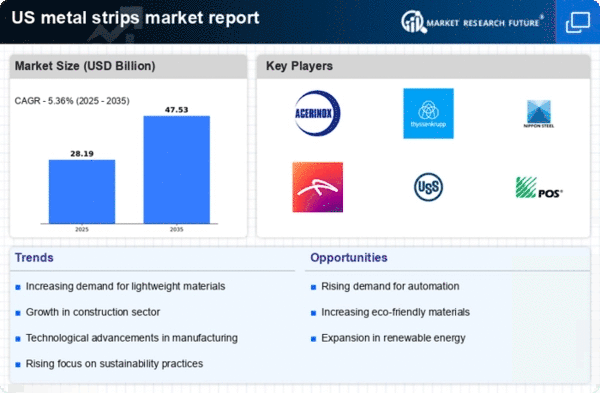

The metal strips market is currently characterized by a competitive landscape that is both dynamic and multifaceted. Key growth drivers include increasing demand from the automotive and construction sectors, alongside a push for lightweight materials that enhance energy efficiency. Major players such as United States Steel (US), Thyssenkrupp (DE), and ArcelorMittal (LU) are strategically positioned to leverage these trends. United States Steel (US) focuses on innovation through advanced manufacturing technologies, while Thyssenkrupp (DE) emphasizes sustainability in its operations. ArcelorMittal (LU) is actively pursuing regional expansion to capture emerging market opportunities, collectively shaping a competitive environment that is increasingly focused on technological advancement and sustainability.In terms of business tactics, companies are localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with a mix of large multinational corporations and smaller regional players. This fragmentation allows for a diverse range of offerings, yet the influence of key players remains substantial, as they set benchmarks for quality and innovation.

In October United States Steel (US) announced a partnership with a leading technology firm to develop AI-driven solutions for optimizing production processes. This strategic move is likely to enhance operational efficiency and reduce costs, positioning the company favorably in a competitive market that increasingly values technological integration.

In September Thyssenkrupp (DE) unveiled a new line of eco-friendly metal strips designed for the automotive industry, which aligns with the growing demand for sustainable materials. This initiative not only strengthens Thyssenkrupp's market position but also reflects a broader industry trend towards sustainability, potentially attracting environmentally conscious customers.

In August ArcelorMittal (LU) completed the acquisition of a regional competitor, thereby expanding its market share and enhancing its product portfolio. This acquisition is indicative of a trend where larger players seek to consolidate their positions through strategic mergers, allowing them to leverage economies of scale and broaden their customer base.

As of November current competitive trends are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the landscape, as companies collaborate to enhance their technological capabilities and sustainability initiatives. Looking ahead, competitive differentiation is expected to evolve, with a notable shift from price-based competition towards innovation, technology adoption, and supply chain reliability. This transition underscores the importance of agility and responsiveness in a market that is rapidly changing.