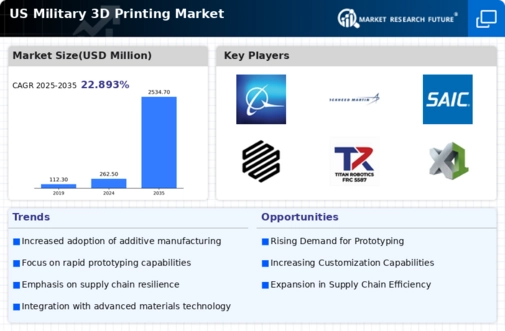

The military 3D printing market is currently characterized by a dynamic competitive landscape, driven by technological advancements and the increasing demand for rapid prototyping and on-demand manufacturing capabilities. Key players such as Lockheed Martin (US), Northrop Grumman (US), and Boeing (US) are strategically positioned to leverage their extensive R&D capabilities and established relationships with defense agencies. These companies focus on innovation and digital transformation, which are essential for maintaining a competitive edge in a market that is becoming increasingly reliant on advanced manufacturing technologies. Their collective strategies not only enhance operational efficiencies but also foster a collaborative environment that encourages the sharing of best practices and technological advancements.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. This approach appears to be particularly effective in a moderately fragmented market where agility and responsiveness are critical. The competitive structure is shaped by the presence of both large defense contractors and specialized 3D printing firms, creating a diverse ecosystem that encourages innovation and competition. The influence of key players is significant, as they set industry standards and drive technological advancements that smaller firms often follow.

In November 2025, Lockheed Martin (US) announced a partnership with 3D Systems (US) to develop advanced materials for military applications. This collaboration is expected to enhance Lockheed's capabilities in producing lightweight, durable components that can withstand extreme conditions, thereby improving the performance of military equipment. The strategic importance of this partnership lies in its potential to accelerate the development of next-generation materials that are crucial for modern warfare.

In October 2025, Northrop Grumman (US) unveiled a new 3D printing facility designed to streamline the production of critical components for unmanned aerial vehicles (UAVs). This facility is anticipated to significantly reduce production times and costs, allowing Northrop to respond more swiftly to military demands. The establishment of this facility underscores Northrop's commitment to innovation and efficiency, positioning the company favorably in a competitive market.

In September 2025, Boeing (US) expanded its 3D printing capabilities by integrating artificial intelligence (AI) into its manufacturing processes. This integration is expected to enhance quality control and optimize production workflows, thereby reducing waste and improving overall efficiency. The strategic move reflects Boeing's focus on digital transformation and its commitment to leveraging cutting-edge technologies to maintain its competitive advantage.

As of December 2025, current trends in the military 3D printing market include a strong emphasis on digitalization, sustainability, and AI integration. Strategic alliances among key players are shaping the landscape, fostering innovation and collaboration. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological innovation, supply chain reliability, and sustainability. Companies that can effectively harness these trends will be better positioned to thrive in an increasingly complex and competitive environment.

Leave a Comment