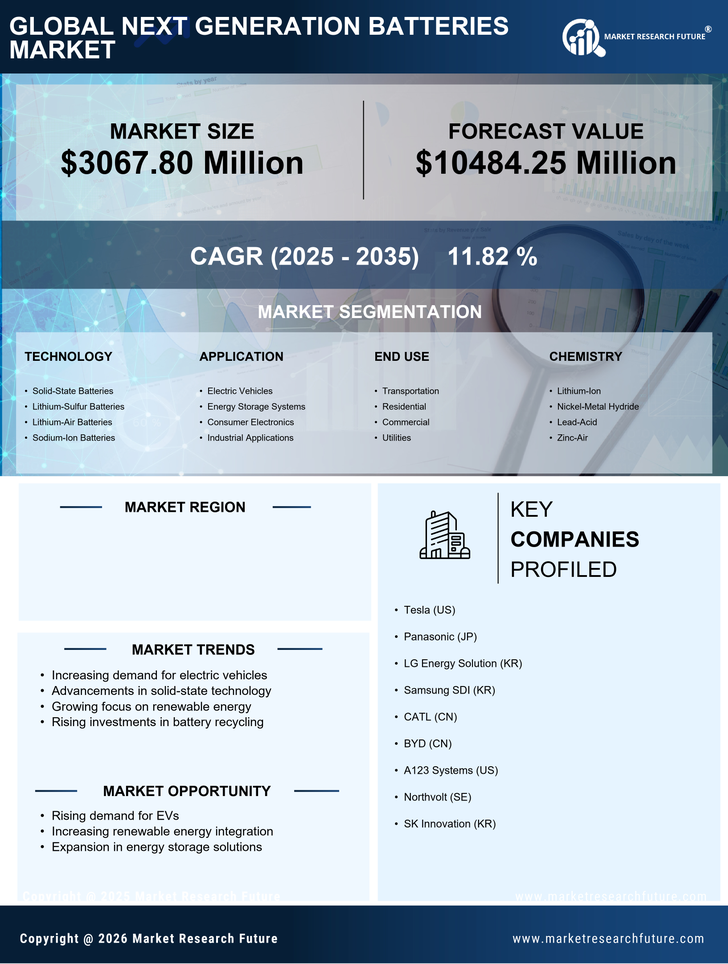

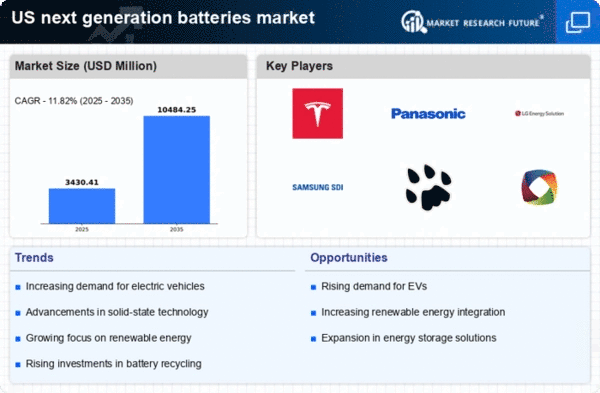

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) in the US is a primary driver for the next generation-batteries market. As consumers become more environmentally conscious, the demand for EVs is projected to grow significantly. According to recent estimates, the EV market is expected to reach a valuation of over $800 billion by 2027, which will likely necessitate advanced battery technologies. This surge in demand for EVs is pushing manufacturers to innovate and develop next generation-batteries that offer higher energy density, faster charging times, and longer lifespans. Consequently, the next generation-batteries market is poised to benefit from this trend, as automakers seek to enhance vehicle performance and sustainability.

Consumer Electronics Market Expansion

The expansion of the consumer electronics market is another significant driver for the next generation-batteries market. With the proliferation of smart devices, wearables, and portable electronics, there is an increasing demand for batteries that can support longer usage times and faster charging capabilities. The consumer electronics sector is projected to grow at a CAGR of over 6% through 2026, which will likely necessitate advancements in battery technology. Manufacturers are focusing on developing next generation-batteries that can meet these demands, thereby enhancing the overall user experience. This trend is expected to create substantial opportunities for growth within the next generation-batteries market.

Integration of Renewable Energy Sources

The integration of renewable energy sources into the US energy grid is a critical factor influencing the next generation-batteries market. As the country shifts towards cleaner energy, the need for efficient energy storage solutions becomes paramount. Next generation-batteries are essential for storing energy generated from solar and wind sources, which are inherently intermittent. The US Department of Energy has indicated that energy storage capacity must increase significantly to support the transition to renewables. This demand for reliable storage solutions is expected to drive growth in the next generation-batteries market, as stakeholders seek to enhance grid stability and reduce reliance on fossil fuels.

Technological Innovations in Energy Storage

Technological advancements in energy storage systems are propelling the next generation-batteries market forward. Innovations such as solid-state batteries and lithium-sulfur batteries are emerging as viable alternatives to traditional lithium-ion batteries. These new technologies promise to deliver higher energy capacities and improved safety features. For instance, solid-state batteries are anticipated to provide up to 50% more energy density compared to conventional batteries. As these technologies mature, they are likely to attract significant investment, with projections indicating that the energy storage market could exceed $200 billion by 2030. This influx of innovation is crucial for the next generation-batteries market, as it aligns with the growing need for efficient and reliable energy storage solutions.

Regulatory Frameworks Promoting Clean Energy

Regulatory frameworks in the US aimed at promoting clean energy are significantly impacting the next generation-batteries market. Policies that incentivize the use of renewable energy and energy storage solutions are becoming increasingly prevalent. For instance, various states have implemented mandates for renewable energy adoption, which often include provisions for energy storage. These regulations are likely to stimulate investment in next generation-batteries, as companies seek to comply with new standards and capitalize on available incentives. The alignment of regulatory support with market needs is expected to foster growth in the next generation-batteries market, driving innovation and adoption across various sectors.