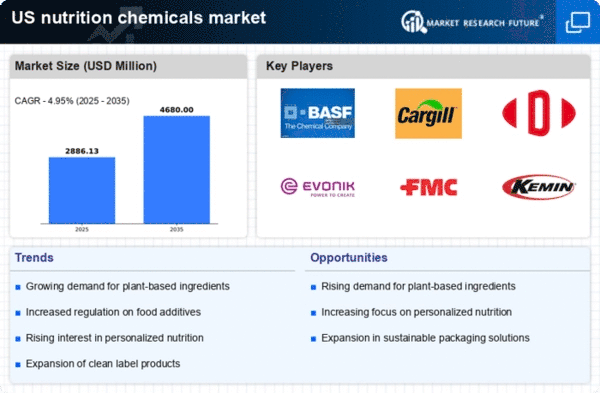

The nutrition chemicals market is currently characterized by a dynamic competitive landscape, driven by increasing consumer demand for health and wellness products, alongside a growing emphasis on sustainability. Major players such as Cargill Inc (US), DuPont de Nemours Inc (US), and Kemin Industries Inc (US) are strategically positioning themselves through innovation and partnerships. Cargill, for instance, focuses on enhancing its product portfolio with plant-based ingredients, which aligns with the rising trend towards natural and organic products. Meanwhile, DuPont emphasizes its commitment to sustainability, investing in bio-based solutions that reduce environmental impact, thereby shaping a competitive environment that prioritizes eco-friendly practices.In terms of business tactics, companies are increasingly localizing manufacturing to enhance supply chain efficiency and reduce costs. The market structure appears moderately fragmented, with several key players exerting significant influence. This fragmentation allows for niche players to thrive, while larger corporations leverage their scale to optimize operations and expand their market reach. The collective influence of these key players fosters a competitive atmosphere where innovation and operational excellence are paramount.

In October Kemin Industries Inc (US) announced the launch of a new line of plant-based nutritional supplements aimed at the growing vegan market. This strategic move not only diversifies Kemin's product offerings but also positions the company to capture a larger share of the health-conscious consumer segment. The introduction of these supplements reflects a broader industry trend towards plant-based nutrition, which is likely to resonate well with consumers seeking sustainable and health-oriented options.

In September DuPont de Nemours Inc (US) expanded its partnership with a leading agricultural technology firm to enhance its capabilities in precision fermentation. This collaboration is expected to accelerate the development of innovative nutritional ingredients, thereby reinforcing DuPont's position as a leader in sustainable nutrition solutions. The strategic importance of this partnership lies in its potential to drive advancements in product efficacy and sustainability, aligning with the increasing regulatory pressures for environmentally friendly practices.

In August Cargill Inc (US) completed the acquisition of a regional flavor and ingredient company, which is anticipated to bolster its capabilities in the nutrition chemicals sector. This acquisition not only enhances Cargill's product portfolio but also strengthens its market presence in the rapidly evolving landscape of flavor and nutrition. The strategic importance of this move is underscored by the growing consumer preference for personalized nutrition solutions, which Cargill aims to address through this expanded offering.

As of November current competitive trends in the nutrition chemicals market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies seek to leverage complementary strengths to enhance innovation and operational efficiency. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technology, and supply chain reliability. This shift suggests that companies that prioritize sustainable practices and technological advancements will be better positioned to thrive in the future.