Rise of Pet Humanization

The trend of pet humanization is a significant driver in the pet food market. Pet owners increasingly view their pets as family members, leading to a willingness to spend more on high-quality food that mirrors human dietary trends. This phenomenon has resulted in a surge in demand for gourmet and artisanal pet food products, with sales in this segment growing by over 25% in recent years. The pet food market is capitalizing on this trend by developing products that feature premium ingredients and unique flavors, often inspired by human cuisine. Additionally, the rise of pet humanization has prompted brands to focus on transparency in sourcing and production, as consumers seek to understand what goes into their pets' food. This shift is likely to continue influencing consumer behavior and market dynamics.

Increased Focus on Sustainability

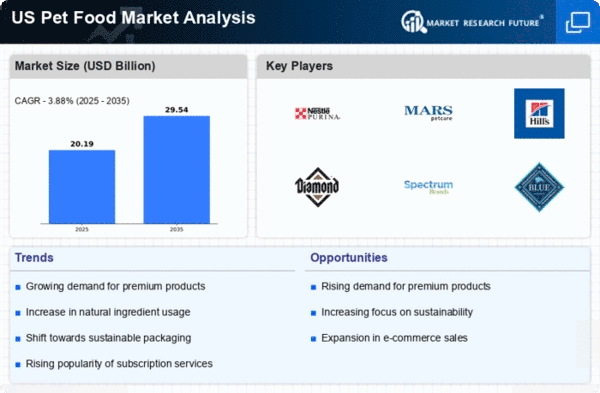

Sustainability is becoming a crucial driver in the pet food market, as consumers are increasingly concerned about the environmental impact of their purchases. Many pet owners are seeking products that are not only healthy for their pets but also produced in an environmentally responsible manner. This has led to a rise in demand for sustainably sourced ingredients and eco-friendly packaging. The pet food market is responding by implementing sustainable practices, such as using renewable resources and reducing carbon footprints in production. Reports indicate that nearly 30% of pet owners are willing to pay a premium for sustainable products, highlighting the potential for growth in this segment. As awareness of environmental issues continues to rise, the focus on sustainability is likely to shape product development and marketing strategies within the pet food market.

Health Consciousness Among Pet Owners

The increasing awareness of health and nutrition among pet owners is a pivotal driver in the pet food market. As consumers become more informed about the dietary needs of their pets, they are more inclined to purchase high-quality, nutritious food options. This trend is reflected in the market, where premium pet food sales have surged, accounting for approximately 40% of total sales in recent years. Pet owners are now prioritizing ingredients, sourcing, and nutritional value, leading to a shift towards organic and natural products. The pet food market is adapting to these demands by innovating and expanding their product lines to include functional foods that promote health benefits, such as joint support and digestive health. This heightened focus on pet wellness is likely to continue influencing purchasing decisions, thereby shaping the future landscape of the pet food market.

Changing Demographics of Pet Ownership

The evolving demographics of pet ownership in the United States are reshaping the pet food market. Younger generations, particularly millennials and Gen Z, are increasingly becoming pet owners, often viewing pets as family members. This shift is driving demand for premium and specialized pet food products that align with their values, such as sustainability and health. Approximately 70% of households in the US own a pet, and this number is expected to rise, further expanding the market. The pet food market is responding by offering products that cater to the preferences of these demographics, including subscription services and personalized nutrition plans. As these trends continue, the market may see a diversification of product offerings to meet the unique needs of a broader consumer base.

Technological Advancements in Production

Technological innovations in the production of pet food are significantly impacting the pet food market. Advances in manufacturing processes, such as extrusion and freeze-drying, enhance the quality and shelf-life of pet food products. These technologies allow for the incorporation of fresh ingredients while maintaining nutritional integrity. Moreover, automation and data analytics in production facilities improve efficiency and reduce costs, which can lead to more competitive pricing for consumers. The pet food market is witnessing a trend where companies invest in research and development to create specialized diets tailored to specific health needs, such as grain-free or hypoallergenic options. This focus on technology not only meets consumer demand for quality but also positions brands as leaders in innovation, potentially increasing market share in a competitive landscape.