US Polymer Foam Market Summary

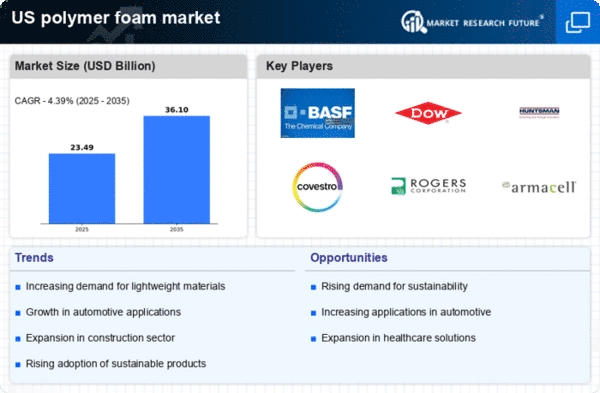

As per Market Research Future analysis, the US polymer foam market Size was estimated at 22.5 USD Billion in 2024. The US polymer foam market is projected to grow from 23.49 USD Billion in 2025 to 36.1 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US polymer foam market is experiencing a dynamic shift towards sustainability and innovation.

- Sustainability initiatives are increasingly shaping product development and consumer preferences in the polymer foam market.

- Technological advancements are driving efficiency and performance improvements across various applications, particularly in automotive and construction sectors.

- Market diversification is evident as manufacturers explore new applications in healthcare and packaging, responding to evolving consumer demands.

- Rising demand in the automotive sector and growth in construction activities are key drivers propelling the expansion of the polymer foam market.

Market Size & Forecast

| 2024 Market Size | 22.5 (USD Billion) |

| 2035 Market Size | 36.1 (USD Billion) |

| CAGR (2025 - 2035) | 4.39% |

Major Players

BASF SE (DE), Dow Inc. (US), Huntsman Corporation (US), Covestro AG (DE), Rogers Corporation (US), Armacell International S.A. (LU), Recticel (BE), Sealed Air Corporation (US), Zotefoams plc (GB)