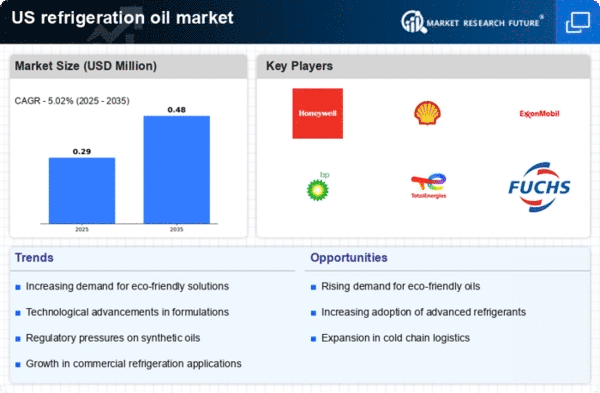

The refrigeration oil market is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as Honeywell (US), ExxonMobil (US), and Shell (GB) are actively pursuing strategies that emphasize technological advancements and eco-friendly solutions. For instance, Honeywell (US) has focused on developing low-global warming potential (GWP) refrigerants, which aligns with the growing regulatory pressures for environmentally sustainable products. This strategic positioning not only enhances their market share but also reinforces their commitment to sustainability, thereby influencing the competitive dynamics of the market.In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The competitive structure of the refrigeration oil market appears moderately fragmented, with several key players exerting significant influence. This fragmentation allows for a diverse range of products and innovations, while also fostering competition among established and emerging companies.

In October ExxonMobil (US) announced a partnership with a leading technology firm to develop advanced synthetic refrigeration oils aimed at improving energy efficiency in commercial refrigeration systems. This strategic move is likely to position ExxonMobil (US) as a frontrunner in the high-performance segment of the market, catering to the increasing demand for energy-efficient solutions. The collaboration underscores the importance of technological innovation in maintaining competitive advantage.Similarly, in September 2025, Shell (GB) launched a new line of biodegradable refrigeration oils, which are designed to meet the stringent environmental regulations being adopted across various states. This initiative not only reflects Shell's commitment to sustainability but also addresses the growing consumer preference for eco-friendly products. By diversifying their product offerings, Shell (GB) is likely to capture a larger share of the market, particularly among environmentally conscious consumers.

In August Honeywell (US) expanded its production capacity for low-GWP refrigerants in response to increasing regulatory demands and market trends favoring sustainable solutions. This expansion is expected to enhance Honeywell's (US) ability to meet the rising demand for environmentally friendly refrigeration oils, thereby solidifying its competitive position in the market. The proactive approach taken by Honeywell (US) illustrates the critical role of adaptability in a rapidly evolving market landscape.

As of November the refrigeration oil market is witnessing trends that emphasize digitalization, sustainability, and the integration of artificial intelligence (AI) in product development and supply chain management. Strategic alliances are becoming increasingly vital, as companies seek to leverage shared expertise and resources to enhance their competitive positioning. Looking ahead, it appears that competitive differentiation will increasingly hinge on innovation and technological advancements rather than solely on price. The shift towards sustainable practices and reliable supply chains is likely to redefine the competitive landscape, compelling companies to invest in R&D and strategic partnerships to maintain their market relevance.