Government Incentives and Policies

The US Renewable Chemicals Market benefits significantly from government incentives and policies aimed at promoting renewable energy and sustainable practices. Federal and state governments have implemented various programs that provide financial support, tax credits, and grants to companies engaged in the production of renewable chemicals. For instance, the Renewable Fuel Standard (RFS) encourages the use of biofuels, which indirectly supports the renewable chemicals sector. These policies create a favorable environment for investment and innovation, enabling companies to expand their operations and develop new products. As a result, the US renewable chemicals market is likely to see increased participation from both established players and new entrants, fostering competition and driving further advancements in the industry.

Shift Towards Circular Economy Practices

The shift towards circular economy practices is influencing the US Renewable Chemicals Market in profound ways. Companies are increasingly adopting strategies that emphasize resource efficiency, waste reduction, and the recycling of materials. This approach aligns with the growing emphasis on sustainability and environmental responsibility among consumers and businesses alike. By integrating circular economy principles, companies can create renewable chemicals from waste materials, thereby reducing reliance on virgin resources. This not only contributes to environmental conservation but also opens new avenues for innovation and product development. As the circular economy gains traction, the US renewable chemicals market is expected to expand, driven by the need for sustainable solutions that address both economic and environmental challenges.

Increased Demand for Sustainable Products

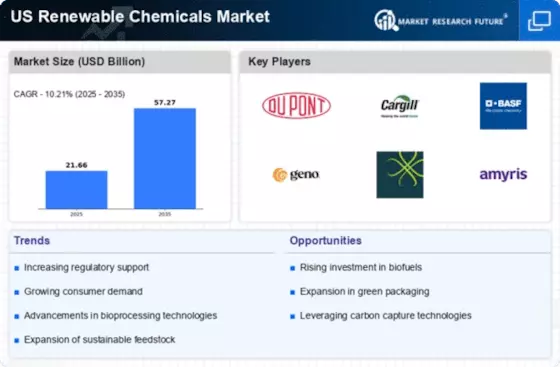

The US Renewable Chemicals Market is experiencing a notable surge in demand for sustainable products. Consumers are increasingly prioritizing eco-friendly options, which has led to a shift in purchasing behavior. According to recent data, the market for renewable chemicals is projected to grow at a compound annual growth rate (CAGR) of approximately 10% through 2028. This growth is driven by heightened awareness of environmental issues and the desire for products that minimize carbon footprints. Companies in the US are responding by developing innovative renewable chemical solutions that align with consumer preferences. This trend not only supports sustainability goals but also enhances brand loyalty, as consumers are more likely to support businesses that demonstrate a commitment to environmental stewardship.

Growing Investment in Research and Development

Investment in research and development (R&D) is a key driver of growth in the US Renewable Chemicals Market. Companies are allocating substantial resources to explore new feedstocks, improve production methods, and develop innovative applications for renewable chemicals. This focus on R&D is essential for overcoming existing challenges, such as scalability and cost competitiveness. Recent reports indicate that R&D spending in the renewable chemicals sector has increased significantly, with many firms collaborating with academic institutions and research organizations to accelerate innovation. As a result, the US is likely to see the emergence of novel renewable chemical products that meet evolving market demands and regulatory requirements, further solidifying its position as a leader in the global renewable chemicals landscape.

Technological Advancements in Production Processes

Technological advancements play a crucial role in shaping the US Renewable Chemicals Market. Innovations in production processes, such as biocatalysis and fermentation technologies, are enhancing the efficiency and cost-effectiveness of renewable chemical production. These technologies enable the conversion of biomass into valuable chemicals with reduced energy consumption and waste generation. For example, companies are increasingly adopting integrated biorefineries that optimize resource utilization and minimize environmental impact. As these technologies continue to evolve, they are expected to lower production costs and improve the competitiveness of renewable chemicals compared to traditional petrochemicals. This shift could lead to a broader adoption of renewable chemicals across various industries, including plastics, textiles, and pharmaceuticals.