Growing Focus on Grid Resilience

The growing focus on grid resilience is emerging as a key driver for the substation monitoring market. With increasing frequency of extreme weather events and cyber threats, utilities are prioritizing the enhancement of grid reliability and security. Advanced monitoring systems provide critical data that helps in identifying vulnerabilities and implementing timely interventions. The substation monitoring market is responding to this need by developing solutions that offer real-time monitoring and automated alerts. This proactive approach is essential for maintaining grid integrity, especially as the U.S. aims to modernize its infrastructure. Investments in resilience-focused monitoring technologies are expected to rise, reflecting the industry's commitment to safeguarding energy supply.

Rising Demand for Energy Efficiency

The substation monitoring market is experiencing a notable surge in demand for energy efficiency solutions. Utilities and energy providers are increasingly focusing on optimizing their operations to reduce energy waste and enhance overall performance. This trend is driven by regulatory pressures and the need to meet sustainability goals. According to recent data, energy efficiency initiatives can lead to reductions in operational costs by up to 20%. As a result, investments in advanced monitoring technologies are becoming essential for utilities aiming to improve their energy management strategies. The substation monitoring market is thus positioned to benefit from this growing emphasis on energy efficiency, as utilities seek to implement real-time monitoring systems that provide actionable insights into energy consumption patterns.

Integration of Renewable Energy Sources

The integration of renewable energy sources into the power grid is significantly influencing the substation monitoring market. As the share of renewables like solar and wind increases, utilities face challenges in maintaining grid stability and reliability. Advanced monitoring solutions are essential for managing the variability associated with these energy sources. The substation monitoring market is adapting to this shift by offering technologies that enable real-time data collection and analysis, facilitating better decision-making. Reports indicate that the share of renewables in the energy mix is projected to reach 50% by 2030, necessitating robust monitoring systems to ensure seamless integration and operational efficiency.

Increased Investment in Smart Grid Initiatives

Increased investment in smart grid initiatives is significantly impacting the substation monitoring market. As utilities modernize their infrastructure, there is a growing emphasis on integrating advanced monitoring systems that enhance operational efficiency and reliability. Smart grid technologies facilitate better communication and data exchange between substations and control centers, leading to improved decision-making. The substation monitoring market is poised to benefit from this trend, with projections indicating that smart grid investments could exceed $100 billion by 2030. This influx of capital is likely to drive the adoption of innovative monitoring solutions, positioning the industry for substantial growth in the coming years.

Technological Advancements in Monitoring Solutions

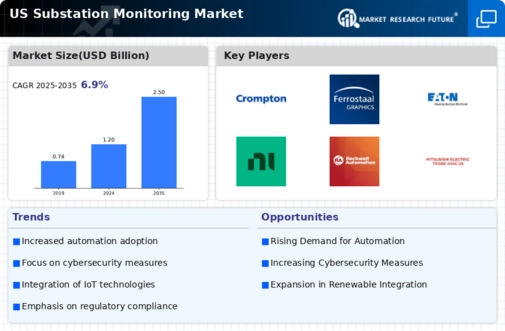

Technological advancements are playing a crucial role in shaping the substation monitoring market. Innovations such as artificial intelligence, machine learning, and big data analytics are enhancing the capabilities of monitoring systems. These technologies allow for predictive maintenance, reducing downtime and operational costs. The substation monitoring market is witnessing a shift towards more sophisticated solutions that can analyze vast amounts of data in real-time. This evolution is expected to drive market growth, with estimates suggesting a compound annual growth rate (CAGR) of 10% over the next five years. As utilities seek to leverage these advancements, the demand for cutting-edge monitoring solutions is likely to increase.