Growing Demand for Energy Efficiency

Energy efficiency remains a critical focus in the turbine control-systems market, as industries seek to reduce energy consumption and operational costs. The increasing pressure to meet sustainability goals and reduce carbon footprints has led to a heightened demand for efficient turbine control systems. According to recent data, energy-efficient systems can reduce operational costs by up to 20%, making them attractive to operators. This trend is further supported by government incentives aimed at promoting energy-efficient technologies, thereby driving growth in the turbine control-systems market. As organizations prioritize sustainability, the demand for energy-efficient solutions is likely to continue rising.

Increased Focus on Operational Safety

Operational safety is paramount in the turbine control-systems market, particularly in industries such as energy and manufacturing. The implementation of stringent safety regulations and standards has prompted companies to invest in advanced control systems that enhance safety measures. These systems are designed to monitor turbine performance and detect anomalies, thereby preventing potential failures. The market is likely to see a rise in demand for safety-enhancing technologies, as organizations prioritize risk management and compliance with safety regulations. This focus on operational safety is expected to drive growth in the turbine control-systems market.

Expansion of Renewable Energy Projects

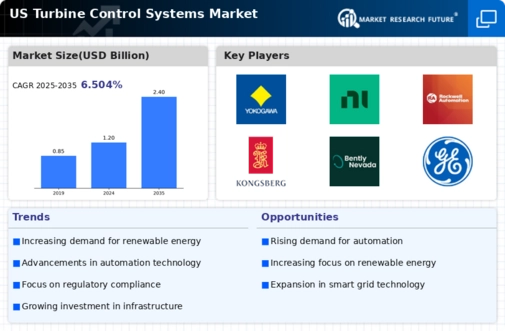

The expansion of renewable energy projects significantly influences the turbine control-systems market. As the US transitions towards cleaner energy sources, the demand for wind and hydroelectric power is increasing. This shift necessitates advanced control systems to manage the complexities associated with renewable energy generation. The turbine control-systems market is expected to benefit from this trend, with investments in wind energy projected to exceed $50 billion by 2025. The integration of turbine control systems in these projects is essential for optimizing energy output and ensuring grid stability, thus driving market growth.

Technological Advancements in Control Systems

The turbine control-systems market is experiencing a surge in technological advancements, particularly in automation and data analytics. These innovations enhance operational efficiency and reliability, allowing for real-time monitoring and predictive maintenance. The integration of advanced algorithms and machine learning techniques enables turbines to optimize performance under varying conditions. As a result, companies are increasingly investing in these technologies, with the market projected to reach approximately $3 billion by 2026. This growth is driven by the need for improved efficiency and reduced operational costs, making technological advancements a key driver in the turbine control-systems market.

Rising Investment in Infrastructure Development

Rising investment in infrastructure development is a significant driver for the turbine control-systems market. As the US government and private sector allocate funds towards upgrading energy infrastructure, the demand for modern turbine control systems is expected to increase. This investment is crucial for enhancing the efficiency and reliability of energy generation facilities. The turbine control-systems market is projected to benefit from these developments, with infrastructure spending anticipated to reach $1 trillion by 2027. This influx of capital is likely to stimulate innovation and adoption of advanced control technologies, further propelling market growth.

Leave a Comment