Increased Adoption of OTT Platforms

The rise of Over-The-Top (OTT) platforms is a significant driver for the Video Encoder Market. As consumers increasingly prefer on-demand content, platforms like Netflix, Hulu, and Disney+ have gained immense popularity. This shift in viewing habits has led to a surge in the need for efficient video encoding solutions that can deliver high-quality content across various devices. The OTT market is projected to grow substantially, with estimates suggesting it could reach over 200 billion USD by 2025. Consequently, the demand for video encoders that can support multiple formats and resolutions is likely to increase, thereby enhancing the overall market dynamics.

Growing Importance of Video Marketing

The rising significance of video marketing is a notable driver for the Video Encoder Market. Businesses are increasingly leveraging video content to engage consumers and enhance brand visibility. Studies indicate that video marketing can lead to a 66% increase in qualified leads per year. As companies recognize the effectiveness of video in their marketing strategies, the demand for high-quality video production and encoding solutions is expected to rise. This trend not only boosts the need for advanced video encoders but also encourages innovation within the industry, as companies seek to differentiate their content in a competitive landscape.

Expansion of Video Content Consumption

The proliferation of video content across various platforms significantly influences the Video Encoder Market. With the rise of social media and video-sharing platforms, the consumption of video content has reached unprecedented levels. Reports indicate that video content is projected to account for over 80% of all internet traffic by 2025. This surge necessitates efficient video encoding solutions to manage the vast amounts of data generated. As businesses and content creators strive to deliver high-quality video experiences, the demand for sophisticated video encoders that can handle diverse formats and resolutions is likely to increase, thereby driving market growth.

Rising Demand for Live Streaming Services

The increasing popularity of live streaming services is a primary driver for the Video Encoder Market. As consumers seek real-time content, platforms such as Twitch and YouTube Live have surged in usage. This trend is reflected in the projected growth of the live streaming market, which is expected to reach approximately 70 billion USD by 2027. Consequently, video encoders are essential for ensuring high-quality streaming experiences, as they compress and convert video files for efficient transmission. The demand for low-latency and high-resolution streaming further propels the need for advanced video encoding technologies, thereby enhancing the overall market landscape.

Technological Advancements in Encoding Solutions

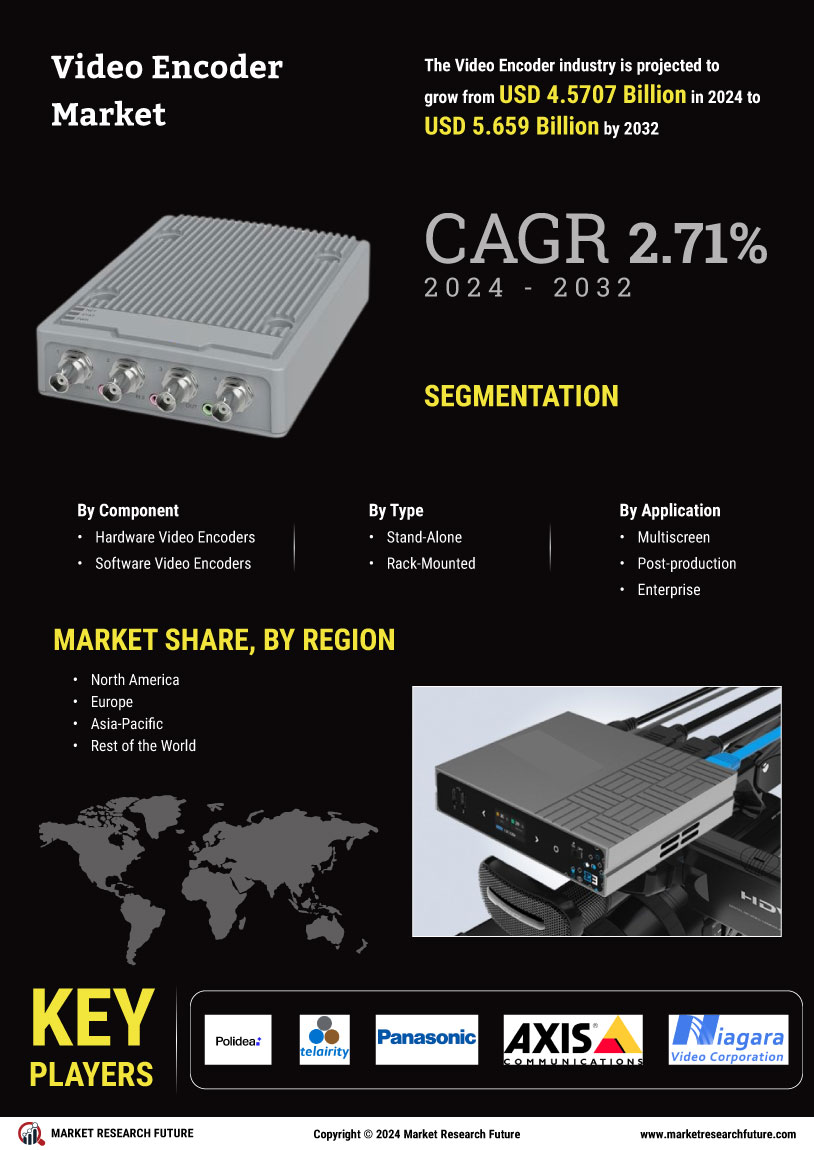

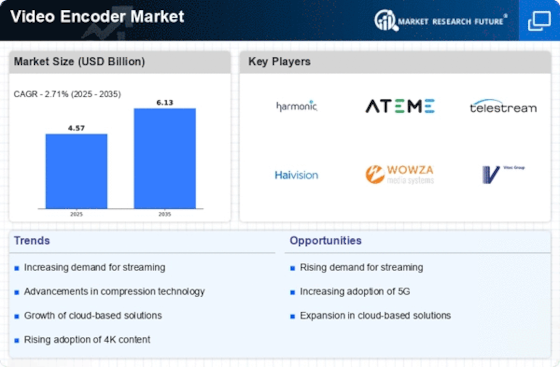

Technological innovations play a crucial role in shaping the Video Encoder Market. The advent of advanced encoding algorithms and hardware accelerators has enhanced the efficiency and quality of video encoding processes. For instance, the introduction of HEVC (High Efficiency Video Coding) has allowed for better compression rates without compromising video quality. As a result, the market for video encoders is expected to witness a compound annual growth rate (CAGR) of around 15% over the next few years. These advancements not only improve the user experience but also enable content providers to optimize bandwidth usage, further stimulating market demand.