Rising Popularity of Video Content

The increasing consumption of video content across various platforms appears to be a primary driver for the Video Production Equipment Market. With the proliferation of social media and video-sharing platforms, content creators are seeking high-quality production tools to enhance their output. According to recent data, video content is projected to account for over 80% of all internet traffic by 2025. This trend suggests that demand for advanced video production equipment, including cameras, lighting, and editing software, is likely to rise significantly. As more individuals and businesses recognize the value of engaging video content, the Video Production Equipment Market is expected to experience substantial growth, driven by the need for innovative and efficient production solutions.

Emergence of Virtual Events and Webinars

The rise of virtual events and webinars has emerged as a significant driver for the Video Production Equipment Market. As organizations pivot to online formats for conferences, workshops, and seminars, the need for reliable and sophisticated video production tools has become paramount. The market for virtual events is projected to grow substantially, with estimates suggesting it could reach 404 billion dollars by 2027. This growth indicates a robust demand for video production equipment that can facilitate high-quality streaming and recording. Consequently, the Video Production Equipment Market is likely to benefit from this trend, as companies invest in advanced technology to enhance their virtual engagement capabilities.

Increased Investment in Content Creation

The surge in investment in content creation by brands and businesses is driving the Video Production Equipment Market. Companies are recognizing the importance of video marketing and are allocating substantial budgets to produce high-quality video content. Recent statistics suggest that video marketing budgets are expected to increase by 25% in the coming years. This trend indicates a growing reliance on professional video production equipment to meet the demands of high-quality content creation. As businesses strive to differentiate themselves in a competitive landscape, the Video Production Equipment Market is likely to see increased demand for innovative production tools that can deliver exceptional results.

Growth of E-Learning and Online Education

The expansion of e-learning and online education platforms is contributing to the growth of the Video Production Equipment Market. Educational institutions and organizations are increasingly adopting video as a medium for delivering content, which necessitates the use of professional-grade production equipment. Data indicates that the e-learning market is anticipated to reach a valuation of over 375 billion dollars by 2026, highlighting the potential for video production tools in this sector. As educators strive to create engaging and interactive learning experiences, the demand for high-quality video production equipment is likely to surge, further propelling the Video Production Equipment Market.

Technological Innovations in Video Production

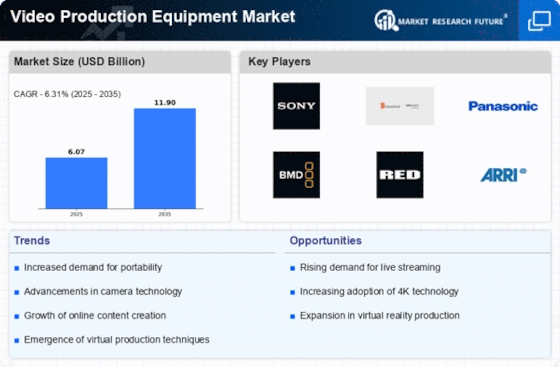

Technological innovations in video production are playing a crucial role in shaping the Video Production Equipment Market. Advancements in camera technology, editing software, and production techniques are enabling creators to produce high-quality content more efficiently. For instance, the introduction of 4K and 8K resolution cameras has transformed the standards of video quality, leading to a heightened demand for such equipment. Furthermore, the integration of artificial intelligence in editing software is streamlining the production process, making it more accessible to a wider audience. As these technologies continue to evolve, the Video Production Equipment Market is expected to expand, driven by the need for cutting-edge tools that enhance the creative process.

Leave a Comment