Expansion of 5G Technology

The expansion of 5G technology is a pivotal driver for the Wafer Processing and Assembly Equipment Market. As telecommunications companies roll out 5G networks, the demand for high-frequency components and advanced semiconductor devices is escalating. This new generation of wireless technology requires sophisticated manufacturing processes to produce chips that can handle increased data speeds and connectivity. By 2025, the 5G infrastructure market is expected to exceed 300 billion USD, indicating a substantial opportunity for equipment manufacturers. The need for specialized wafer processing and assembly equipment to support the production of 5G-compatible devices is likely to drive innovation and investment in the Wafer Processing and Assembly Equipment Market.

Rising Demand for Semiconductors

The increasing demand for semiconductors across various sectors, including consumer electronics, automotive, and telecommunications, is a primary driver for the Wafer Processing and Assembly Equipment Market. As industries continue to digitize and adopt advanced technologies, the need for efficient and high-quality semiconductor manufacturing processes becomes paramount. In 2025, the semiconductor market is projected to reach approximately 600 billion USD, indicating a robust growth trajectory. This surge necessitates the deployment of advanced wafer processing and assembly equipment to meet production demands and maintain competitive advantage. Consequently, manufacturers are investing in innovative technologies to enhance yield and reduce production costs, further propelling the growth of the Wafer Processing and Assembly Equipment Market.

Increased Focus on Miniaturization

The trend towards miniaturization in electronic devices is a significant driver for the Wafer Processing and Assembly Equipment Market. As consumer preferences shift towards smaller, more portable devices, manufacturers are compelled to develop smaller and more efficient semiconductor components. This miniaturization trend is evident in sectors such as mobile technology and wearables, where compact designs are essential. In 2025, the market for miniaturized electronic components is anticipated to expand, necessitating advanced wafer processing techniques to achieve the desired scale and performance. Consequently, the demand for specialized equipment that can handle the intricacies of miniaturized chip production is likely to increase, further stimulating growth in the Wafer Processing and Assembly Equipment Market.

Technological Advancements in Equipment

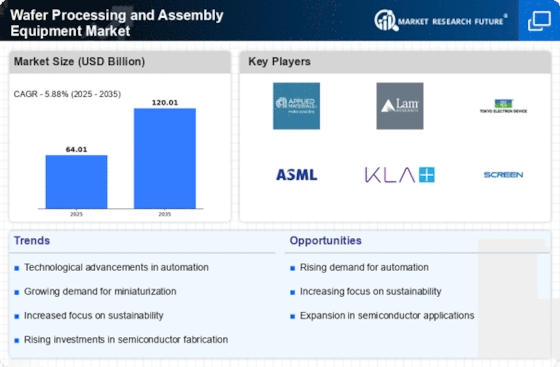

Technological advancements in wafer processing and assembly equipment are significantly influencing the Wafer Processing and Assembly Equipment Market. Innovations such as atomic layer deposition, advanced photolithography, and enhanced etching techniques are enabling manufacturers to produce smaller, more efficient chips. These advancements not only improve the performance of semiconductor devices but also reduce production time and costs. As of 2025, the market for advanced wafer processing technologies is expected to grow at a compound annual growth rate (CAGR) of around 8%, reflecting the industry's shift towards more sophisticated manufacturing processes. This trend underscores the necessity for continuous investment in research and development to keep pace with evolving technological demands, thereby driving the Wafer Processing and Assembly Equipment Market.

Growing Investment in Renewable Energy Technologies

The growing investment in renewable energy technologies is emerging as a crucial driver for the Wafer Processing and Assembly Equipment Market. As the world shifts towards sustainable energy solutions, the demand for efficient solar cells and energy storage systems is rising. This transition necessitates the use of advanced wafer processing techniques to manufacture high-performance photovoltaic cells and batteries. In 2025, the renewable energy sector is projected to witness substantial growth, with investments reaching over 1 trillion USD. This surge in investment is likely to create a robust demand for wafer processing and assembly equipment tailored for renewable energy applications, thereby enhancing the overall market landscape of the Wafer Processing and Assembly Equipment Market.