Cost Efficiency

The White Box Server Market is experiencing a notable shift towards cost efficiency, driven by the increasing demand for budget-friendly computing solutions. Organizations are increasingly opting for white box servers due to their lower initial investment compared to traditional branded servers. This trend is particularly evident in small to medium-sized enterprises that seek to optimize their IT budgets. According to recent data, the average cost of white box servers is approximately 30 to 50% lower than that of branded alternatives. This cost advantage allows businesses to allocate resources to other critical areas, thereby enhancing overall operational efficiency. As the market continues to evolve, the emphasis on cost efficiency is likely to remain a primary driver, influencing purchasing decisions across various sectors.

Vendor Independence

Vendor independence is emerging as a critical driver within the White Box Server Market. Organizations are increasingly seeking to avoid vendor lock-in, which can limit flexibility and increase costs. White box servers provide the opportunity for businesses to select components from various manufacturers, allowing for tailored solutions that meet specific needs. This independence not only fosters innovation but also encourages competitive pricing among suppliers. As a result, companies can optimize their server configurations without being tied to a single vendor's ecosystem. The trend towards vendor independence is particularly pronounced in industries where customization and adaptability are paramount. As the market matures, the emphasis on vendor independence is expected to continue influencing purchasing behaviors and shaping the competitive landscape.

Technological Integration

Technological integration is a driving force in the White Box Server Market, as organizations increasingly seek to leverage advanced technologies to enhance their IT infrastructure. The integration of artificial intelligence, machine learning, and big data analytics into white box servers is becoming more prevalent, enabling businesses to derive actionable insights from their data. This trend is particularly relevant in sectors such as finance and healthcare, where data-driven decision-making is crucial. Recent reports suggest that the adoption of AI-driven white box servers is expected to increase by over 25% in the next few years, reflecting the growing recognition of the value of integrated technologies. As enterprises continue to prioritize technological advancement, the integration capabilities of white box servers are likely to remain a key factor in their market appeal.

Scalability and Performance

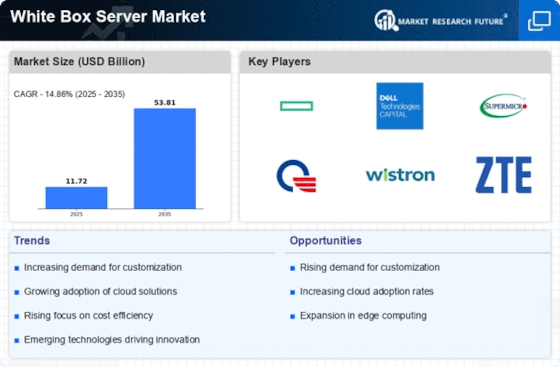

Scalability and performance are pivotal factors propelling the White Box Server Market forward. Organizations are increasingly recognizing the need for scalable solutions that can adapt to their growing data requirements. White box servers offer the flexibility to customize hardware configurations, enabling businesses to scale their operations seamlessly. This adaptability is particularly crucial in sectors such as cloud computing and data centers, where performance demands are continually rising. Recent statistics indicate that the white box server segment is projected to grow at a compound annual growth rate of over 20% in the coming years, reflecting the increasing reliance on high-performance computing solutions. As enterprises seek to enhance their operational capabilities, the scalability and performance attributes of white box servers are likely to play a significant role in shaping market dynamics.

Customization and Adaptability

Customization and adaptability are fundamental drivers in the White Box Server Market, as organizations increasingly demand solutions tailored to their specific operational needs. Unlike traditional servers, white box servers allow for extensive customization in terms of hardware and software configurations. This flexibility is particularly advantageous for businesses operating in dynamic environments, where requirements can change rapidly. The ability to adapt server specifications to meet evolving demands is becoming a critical factor in maintaining competitive advantage. Recent data indicates that the customization segment of the white box server market is projected to grow significantly, with many enterprises prioritizing bespoke solutions. As the market landscape continues to shift, the emphasis on customization and adaptability is expected to shape the future of server procurement strategies.