Government Incentives and Policies

Supportive government policies and incentives are pivotal in driving the Wind Turbine Rotor Blade Market. Many countries have implemented favorable regulations and financial incentives to promote renewable energy projects. For example, tax credits, grants, and subsidies for wind energy installations have become commonplace, encouraging investments in wind turbine technology. In 2025, it is estimated that government funding for renewable energy projects will exceed $100 billion, significantly impacting the market. These initiatives not only stimulate demand for wind turbines but also create a favorable environment for manufacturers of rotor blades, thereby enhancing the overall market landscape.

Rising Demand for Renewable Energy

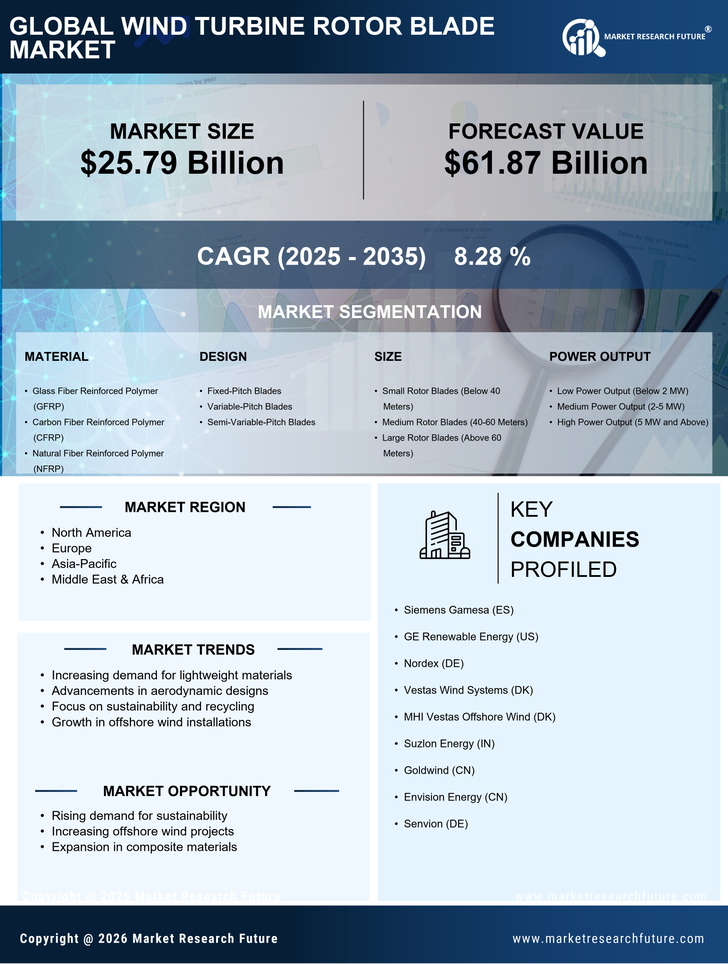

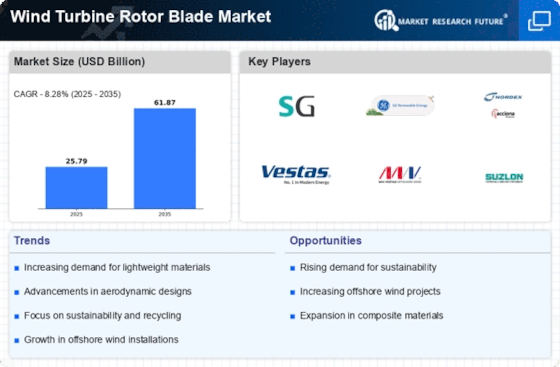

The increasing The Wind Turbine Rotor Blade Industry. As nations strive to meet ambitious carbon reduction targets, the demand for wind energy has surged. In 2025, wind energy accounts for approximately 10% of the total electricity generation, with projections indicating a potential increase to 20% by 2030. This shift towards cleaner energy sources necessitates the production of more efficient and durable rotor blades, thereby propelling market growth. The Wind Turbine Rotor Blade Market is likely to benefit from this trend, as investments in wind energy infrastructure continue to rise, fostering innovation in blade design and materials.

Expansion of Offshore Wind Projects

The expansion of offshore wind projects represents a significant opportunity for the Wind Turbine Rotor Blade Market. Offshore wind farms are increasingly recognized for their potential to generate substantial amounts of energy due to stronger and more consistent wind patterns. By 2025, the offshore wind capacity is projected to reach 200 GW, necessitating the development of specialized rotor blades designed for marine environments. These blades must withstand harsher conditions, which drives innovation in materials and design. As investments in offshore wind infrastructure grow, the Wind Turbine Rotor Blade Market is likely to experience a corresponding increase in demand, further solidifying its role in the renewable energy landscape.

Growing Awareness of Environmental Issues

The heightened awareness of environmental issues among consumers and businesses is influencing the Wind Turbine Rotor Blade Market. As climate change concerns escalate, there is a collective push towards sustainable energy solutions. This societal shift is driving investments in wind energy, as stakeholders recognize the long-term benefits of reducing carbon footprints. In 2025, public sentiment strongly favors renewable energy, with surveys indicating that over 70% of individuals support increased investment in wind power. This growing consciousness is likely to translate into higher demand for wind turbines and, consequently, rotor blades, as companies seek to align with consumer values and regulatory expectations.

Technological Innovations in Blade Design

Technological advancements play a crucial role in shaping the Wind Turbine Rotor Blade Market. Innovations such as the development of lighter and stronger composite materials have enhanced the efficiency and longevity of rotor blades. For instance, the introduction of advanced aerodynamic designs has led to a reduction in drag and an increase in energy capture. In 2025, the market witnesses a notable shift towards larger rotor diameters, which can significantly improve energy output. These innovations not only optimize performance but also reduce maintenance costs, making wind energy more competitive against traditional energy sources. As technology continues to evolve, the Wind Turbine Rotor Blade Market is poised for substantial growth.