Increasing Water Scarcity

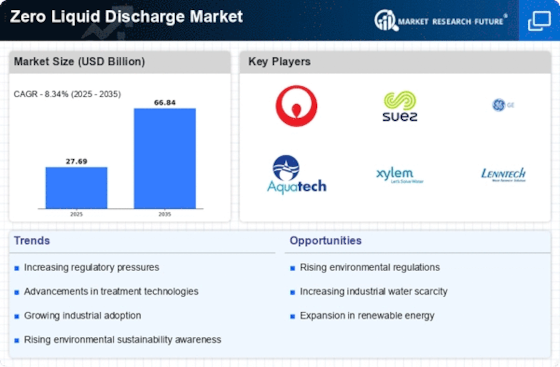

The rising concern over water scarcity is a pivotal driver for the Zero Liquid Discharge Market. As freshwater resources become increasingly limited, industries are compelled to adopt sustainable practices to conserve water. This trend is particularly evident in sectors such as mining, power generation, and textiles, where water usage is substantial. According to recent estimates, the demand for water is projected to exceed supply by 40% by 2030, prompting industries to seek innovative solutions. Zero Liquid Discharge Market systems not only minimize water wastage but also enable the recycling of water, thus addressing the pressing issue of water scarcity. Consequently, the adoption of these systems is likely to accelerate, as companies strive to meet both regulatory requirements and consumer expectations for sustainable practices.

Technological Innovations

Technological innovations play a crucial role in driving the Zero Liquid Discharge Market. Advances in membrane technology, crystallization processes, and evaporation techniques have significantly improved the efficiency and cost-effectiveness of Zero Liquid Discharge Market systems. These innovations enable industries to recover valuable resources from wastewater, such as salts and metals, thereby enhancing the economic viability of these systems. The market is witnessing a surge in research and development activities aimed at optimizing existing technologies and developing new solutions. As these technologies become more accessible and affordable, industries are likely to adopt Zero Liquid Discharge Market systems at an accelerated pace. This trend indicates a promising future for the market, as technological advancements continue to reshape the landscape of wastewater management.

Stringent Environmental Regulations

The imposition of stringent environmental regulations is a significant driver for the Zero Liquid Discharge Market. Governments worldwide are increasingly enacting laws aimed at reducing industrial waste and promoting sustainable water management practices. For instance, regulations that limit the discharge of wastewater into natural water bodies compel industries to adopt Zero Liquid Discharge Market technologies. The market for these systems is expected to grow as companies seek compliance with these regulations to avoid hefty fines and reputational damage. In many regions, the regulatory landscape is evolving, with more stringent standards anticipated in the coming years. This trend suggests that industries will increasingly invest in Zero Liquid Discharge Market solutions to ensure compliance and enhance their environmental stewardship.

Rising Industrialization and Urbanization

The ongoing trends of industrialization and urbanization are significant drivers for the Zero Liquid Discharge Market. As urban areas expand and industries proliferate, the demand for water and the generation of wastewater are increasing at an unprecedented rate. This surge in water usage necessitates the implementation of sustainable wastewater management solutions, such as Zero Liquid Discharge Market systems. Industries in sectors like chemicals, textiles, and food processing are particularly affected, as they face mounting pressure to manage their water resources efficiently. The market is expected to grow as these industries seek to mitigate their environmental impact and comply with regulatory requirements. The interplay between industrial growth and the need for sustainable practices suggests a robust future for the Zero Liquid Discharge Market.

Corporate Social Responsibility Initiatives

Corporate Social Responsibility (CSR) initiatives are becoming a driving force in the Zero Liquid Discharge Market. Companies are increasingly recognizing the importance of sustainable practices not only for compliance but also for enhancing their brand image and stakeholder trust. The integration of Zero Liquid Discharge Market systems aligns with CSR goals by demonstrating a commitment to environmental sustainability. As consumers become more environmentally conscious, businesses are motivated to adopt practices that reflect their values. This shift is evident in various sectors, including pharmaceuticals and food processing, where companies are investing in Zero Liquid Discharge Market technologies to minimize their environmental footprint. The growing emphasis on CSR is likely to propel the adoption of these systems, as organizations strive to meet the expectations of their customers and investors.

Leave a Comment