塑料回收设备市场 摘要

根据MRFR分析,塑料回收设备市场规模在2024年估计为82.81亿美元。塑料回收设备行业预计将从2025年的87.62亿美元增长到2035年的154.2亿美元,展现出在2025年至2035年预测期内5.81的年均增长率(CAGR)。

主要市场趋势和亮点

塑料回收设备市场因技术进步和日益增强的环保意识而有望实现显著增长。

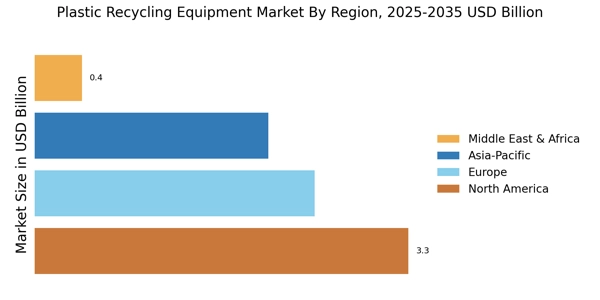

- 北美仍然是塑料回收设备最大的市场,这得益于严格的法规和强大的回收基础设施。

- 亚太地区正迅速崛起,成为增长最快的地区,这得益于对可持续实践的需求增加和对回收技术的投资。

- 碎纸机在市场上占据主导地位,是最大的细分市场,而颗粒机由于其在材料处理中的高效性,正经历快速增长。

- 主要市场驱动因素包括日益增强的环境意识和促进回收倡议的政府法规。

市场规模与预测

| 2024 Market Size | 82.81亿美元 |

| 2035 Market Size | 154.2(亿美元) |

| CAGR (2025 - 2035) | 5.81% |

主要参与者

维科普兰股份公司 (德), Erema 工程回收机械及设备有限公司 (奥), BHS-索恩霍芬有限公司 (德), NGR (下一代回收机械有限公司) (奥), 塑料回收技术 (美), Sorema S.r.l. (意), 克劳斯-马菲集团有限公司 (德), 赫尔博尔德·梅克斯海姆有限公司 (德), 科佩里昂有限公司 (德)