Market Share

Introduction: Navigating the Competitive Landscape of Disaster Recovery as a Service

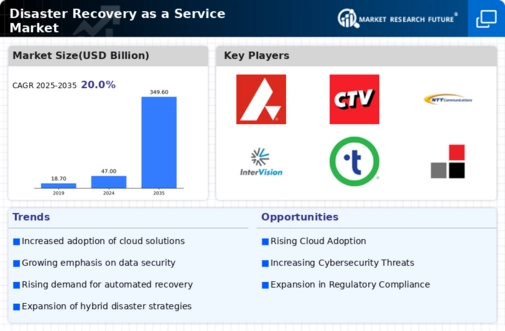

The market for disaster recovery is reshaping itself, driven by rapid technology changes, tighter regulatory controls and increasing customer expectations for resilience and availability. Competition for leadership is intense, with the main players including original equipment manufacturers, IT systems integrators, hosting and cloud service companies, and a new generation of start-ups. They are using advanced capabilities such as artificial intelligence, automation and IoT to gain a lead. These technology-driven differentiators not only enhance service offerings, but also change customer engagement and operational efficiency. Strategic deployment trends in North America and Asia-Pacific focus on hybrid cloud solutions and green initiatives. Strategic planners and senior managers need to understand these dynamics to exploit the next wave of opportunities.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive disaster recovery solutions that integrate various services and technologies for end-to-end recovery management.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| HP Enterprises Company | Robust enterprise solutions | Comprehensive IT recovery | Global |

| Microsoft Corporation | Seamless cloud integration | Cloud-based recovery solutions | Global |

| IBM Corporation | Advanced AI-driven recovery | Hybrid cloud disaster recovery | Global |

| Amazon Web Services | Scalable cloud infrastructure | Cloud disaster recovery | Global |

Specialized Technology Vendors

These vendors focus on niche technologies and services tailored for specific disaster recovery needs.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| VMware Inc. | Virtualization expertise | Virtual disaster recovery solutions | Global |

| Acronis International GmbH | Integrated backup and recovery | Data protection and recovery | Global |

| Infrascale | Rapid recovery capabilities | Cloud backup and DR | North America, Europe |

Infrastructure & Equipment Providers

These vendors provide the necessary hardware and infrastructure to support disaster recovery solutions.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Cisco Systems | Networking and security integration | Infrastructure for DR | Global |

| NTT Communications | Global network reach | Telecommunications and DR | Asia, Global |

| TierPoint, LLC | Multi-cloud capabilities | Data center and DR services | United States |

| Sungard Availability Services | Long-standing industry experience | Managed DR services | North America, Europe |

Emerging Players

These vendors are newer entrants or niche players focusing on innovative solutions in the disaster recovery space.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Treo Information Technology | Tailored IT solutions | Custom DR services | North America |

| InterVision | Cloud-first approach | Cloud and DR services | United States |

| KDDI Corp. | Strong telecom integration | Telecom and DR solutions | Asia |

| Cable & Wireless Communications | Regional telecom expertise | Telecom-based DR | Caribbean, Latin America |

| SpaceX | Innovative technology applications | Satellite-based DR solutions | Global |

| The LEMOINE Company | Construction and recovery synergy | Physical recovery services | United States |

| Insight Partners | Investment-driven innovation | Venture-backed DR solutions | Global |

Emerging Players & Regional Champions

- Zerto (Germany): specializes in providing continuous data protection and disaster recovery for virtualized and cloud environments, recently won a contract with a major health care provider to secure their data and is a strong competitor of established companies like Veeam by offering more flexible recovery options.

- Acronis (Singapore): Offers a complete disaster recovery and data protection solution with integrated cyber security features. Recently it has implemented a solution for a regional bank, complementing the offerings of the traditional vendors by providing a unified platform for data protection and security.

- CloudEndure (Israel): Focuses on disaster recovery solutions for cloud environments, recently partnered with AWS to enhance their service offerings, challenging traditional on-premise solutions by promoting cloud-native recovery strategies.

- Datto (United States): Provides data backup, recovery and continuity solutions for MSPs. The company has recently launched its services in Europe, where it complements the established players by focusing on small and medium-sized businesses with its user-friendly solutions.

- Kaseya (USA): Offers IT management solutions that include disaster recovery as a service, recently acquired Datto to strengthen its market position, challenging established vendors by integrating DRaaS into a broader IT management suite.

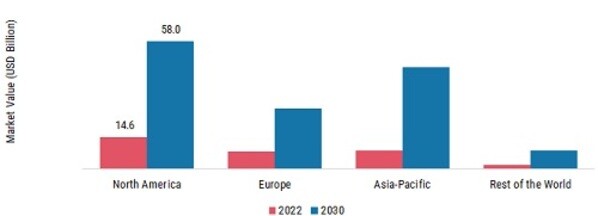

Regional Trends: In 2023, the use of disaster recovery as a service will increase considerably, especially in North America and Europe, driven by the need for business continuity and data protection. Companies are increasingly specializing in cloud-based solutions that are tightly integrated with existing IT architectures and security measures. The focus is on flexible, scalable and cost-effective solutions for small and medium-sized enterprises, as well as for the specific needs of the health care and financial services industries.

Collaborations & M&A Movements

- IBM and VMware announced a partnership to integrate their disaster recovery solutions, aiming to enhance cloud resilience and improve customer service offerings in the competitive DRaaS market.

- Acronis acquired the backup and disaster recovery assets of CloudBerry Lab to strengthen its position in the SMB segment and expand its service portfolio.

- Zerto and Microsoft entered into a collaboration to provide integrated disaster recovery solutions on Azure, enhancing their competitive positioning against other cloud service providers.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Data Backup and Restoration | Veeam, Acronis | Veeam is a provider of reliable backup and recovery solutions for businesses, widely used in enterprise environments for its scalability and reliability. Veeam's unique combination of backup and ransomware protection makes it a strong choice for businesses concerned about data security. |

| Cloud Integration | IBM Cloud, Microsoft Azure | The IBM Cloud excels at hybrid cloud solutions, enabling a seamless integration of on-premises systems. The disaster recovery services from Microsoft Azure are highly scalable and integrated with other services from Microsoft, making them the preferred choice for organisations already using the Microsoft products. |

| Automated Failover | Zerto, Datto | Zerto is a backup solution that is known for its continuous data protection and automatic failover, which minimizes the downtime during a disaster. Datto offers a complete solution for small and medium-sized businesses, with an emphasis on ease of use and fast recovery. |

| Compliance and Security | Druva, Commvault | It is the most appropriate solution for regulated industries. With its extensive security features and compliance reporting, Commvault is a good fit for companies with strict regulatory requirements. |

| Scalability | AWS, Google Cloud | AWS Disaster Recovery provides highly scalable solutions that can grow with your business, backed by a massive global network. AWS Disaster Recovery enables you to quickly respond to changing requirements. |

| User-Friendly Interfaces | CloudEndure, Backupify | CloudEndure is recognized for its intuitive user interface that simplifies disaster recovery management. Backupify focuses on ease of use for SaaS applications, making it accessible for organizations without extensive IT resources. |

Conclusion: Navigating the Competitive DRaaS Landscape

In 2023 the Disaster Recovery as a Service (DRaaS) market will be characterized by a very competitive and highly fragmented environment. The market is dominated by both the old and the new. There is a growing need for tailored solutions, especially in North America and Europe, where the need for compliance and business continuity drives innovation. Strategically, vendors are deploying advanced capabilities such as automation, artificial intelligence and sustainable development to improve service offerings and operational efficiency. As the market evolves, flexibility will become a key differentiator, enabling vendors to meet different customer needs. These are the capabilities that decision-makers should focus on in order to identify the market leaders and align their strategies accordingly.

Leave a Comment