Market Trends

Introduction

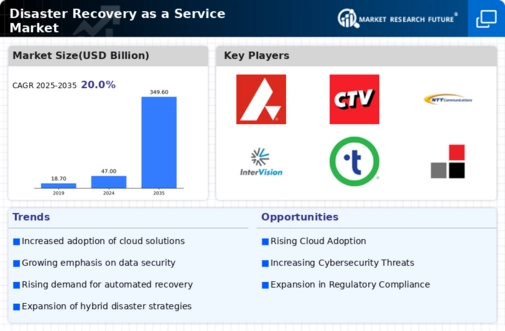

We have now delved into the Disaster Recovery as a Service (DRaaS) market in 2023. As we enter the DRaaS market, a few macro-factors are influencing its development. Firstly, the development of the cloud and data management technology is reshaping the way organizations deal with disaster recovery, making it more efficient and scalable. Secondly, the legal and regulatory framework for data security and compliance is pushing organizations to adopt more robust disaster recovery strategies to meet legal obligations and protect sensitive information. Thirdly, the changes in customer behavior caused by the growing reliance on digital services and the growing awareness of cyber threats are driving companies to put more emphasis on resilience and continuity. These macro-factors are important for all the market participants because they not only increase the strategic importance of DRaaS in risk mitigation, but also increase the need for flexible strategies in the face of continuous change.

Top Trends

-

Increased Adoption of Cloud-Based Solutions

The cloud is a growing source of backup and disaster recovery services. According to Gartner, in fact, a full 70% of businesses use cloud services for backup and recovery. This trend is being driven by the scalability and flexibility of cloud services like those from Amazon Web Services and Microsoft. In the future, as businesses face more frequent cyber attacks, they are likely to rely even more on cloud-based disaster recovery as a service. And as the cloud evolves, it may well offer integrated solutions that combine machine learning for more precise predictions. -

Focus on Cybersecurity Integration

IT is increasingly becoming the target of cyber-attacks, and the integration of cyber-security into disaster recovery plans is becoming paramount. A recent study shows that 60 percent of companies are prioritizing cyber-security in their DRaaS strategies. IT giants like IBM and Cisco are leading the way by offering a unified platform that combines DRaaS with advanced security features. This trend will probably lead to more complete disaster recovery solutions that address both data loss and security breaches. -

Regulatory Compliance and Data Sovereignty

Governments are making regulations on data protection more strict, which is why companies need to ensure compliance with DRaaS. For example, in Europe, the General Data Protection Regulation (GDPR) stipulates certain practices for the handling of data. This has prompted 50 per cent of companies to implement a DRaaS solution. This is driving the cloud industry to offer more localised storage options, which may lead to an increase in market fragmentation as companies look for a compliant solution. -

Automation and Orchestration in Recovery Processes

A key feature of DRaaS is automation, with 65% of organizations having adopted some form of automation. Typical of this trend are the orchestration tools from VMware, which simplify recovery procedures. The automation of recovery procedures reduces the recovery time and the possibility of human error, thereby improving business continuity. In the future, automation may be based on artificial intelligence, thereby improving the efficiency and reliability of recovery procedures even further. -

Hybrid Disaster Recovery Models

IT managers in the enterprise are beginning to adopt the hybrid approach, a model that combines on-premises and cloud-based solutions. The hybrid model is gaining in popularity, with 55% of enterprises already using it. IT managers can use existing on-premises equipment while reaping the benefits of cloud-based solutions, as illustrated by these case studies from Treo Information Technology. Hybrid models are flexible and cost-effective. In the future, hybrid solutions may be even more tightly integrated with on-premises equipment. -

Emphasis on Testing and Validation

A total of 75% of the companies test their disaster recovery plan at least once a year. This is a result of the need for assurance that the recovery processes are functioning properly, as shown by the following examples from Sungard Availability Services. Testing can be improved, resulting in reduced downtime and better recovery times. This will influence the way in which companies will use DRaaS in the future. -

Enhanced User Experience and Accessibility

The users of DRaaS platforms have an 80% ease of use requirement. Acronis focuses on an intuitive and simple recovery process. This can lead to faster recovery times and higher customer satisfaction, which can contribute to the development of more usable solutions in the market. -

Collaboration with Managed Service Providers

DRaaS companies are increasingly forming alliances with MSPs. With 40 per cent of organisations now opting for managed services, these alliances are becoming more important. This is a trend that can benefit all the parties involved. NTT Communications has done just that. Its collaboration with MSPs enhances the service offering and can lead to more specialised solutions. It can also change the DRaaS market. -

Data Analytics for Improved Decision Making

Moreover, the use of data analysis is increasing in DRaaS, and in half of the companies that have implemented a DRaaS solution, data analysis is already used to support recovery strategies. InterVision, for example, is using data analysis to optimize its recovery plans. Besides, with its enhanced data analysis, the company is able to make more informed decisions and to manage its risks proactively. This will have a decisive influence on the future of disaster recovery planning. -

Sustainability and Green Initiatives

A new focus in DRaaS is on the environment. Some 30 per cent of companies are looking for greener solutions. HP Enterprise, for example, is introducing measures to reduce the carbon footprint of its data centres. This trend may lead to the development of more energy-efficient technology and processes, and to the way in which businesses think about disaster recovery in an environmentally friendly way.

Conclusion: Navigating the Competitive DRaaS Landscape

The DRaaS market will be characterized by intense competition and significant fragmentation. Both legacy and new players will compete for market share. In the wake of a growing demand for localized solutions, vendors will be compelled to tailor their offerings to specific regulatory and operational requirements. These players will be able to differentiate themselves on the basis of their established reputation and size, while newcomers will focus on innovation, such as automation based on artificial intelligence and a focus on sustainable development. In the future, the ability to offer flexible service delivery and integration will be critical to market leadership. The vendors that develop these capabilities will not only enhance their competitive position but also meet the expectations of their customers, who will demand more resilient and responsive disaster recovery solutions.

Leave a Comment