Production volume mapping and revenue analysis were employed to determine global market valuation for various material grades and fastening technologies. The methodology comprised the following:

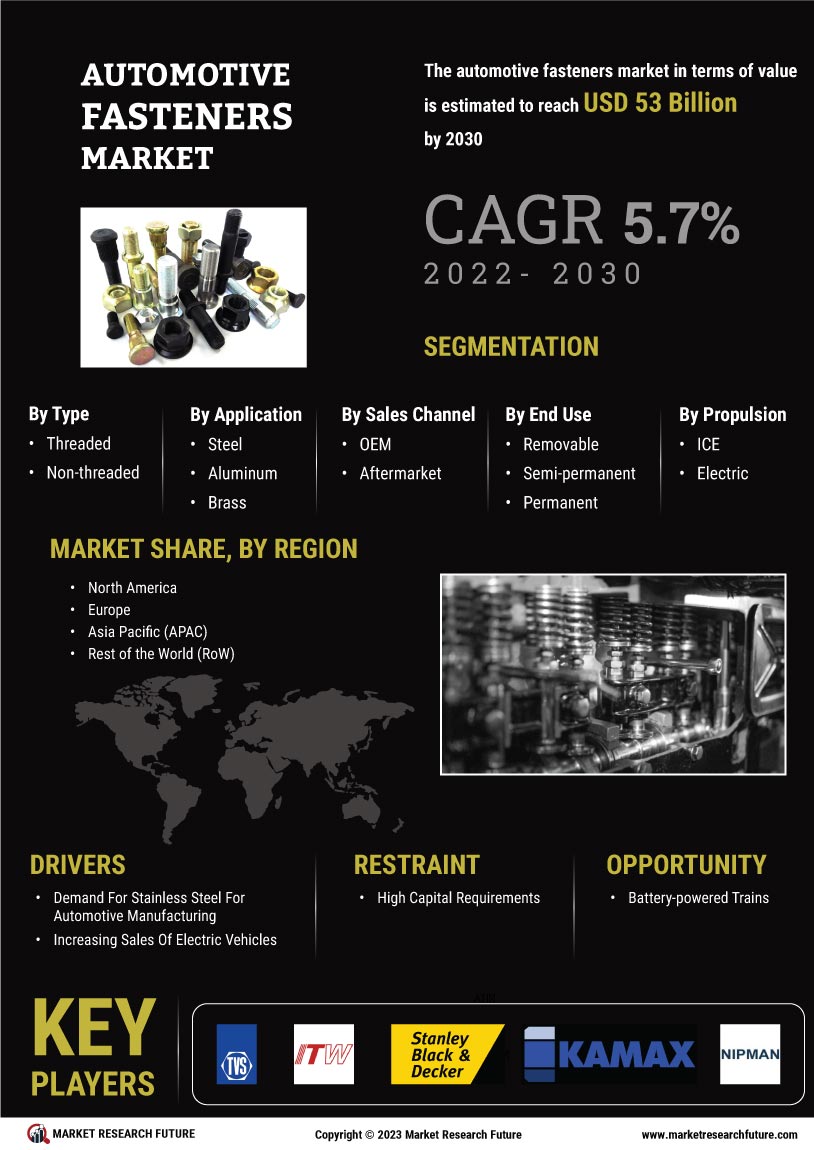

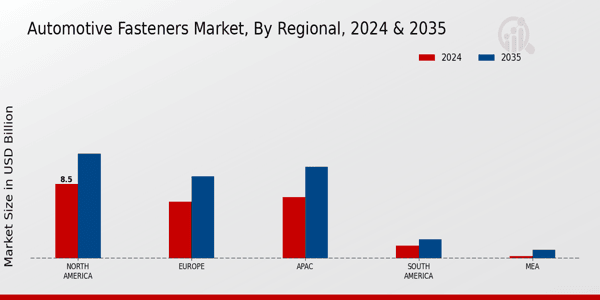

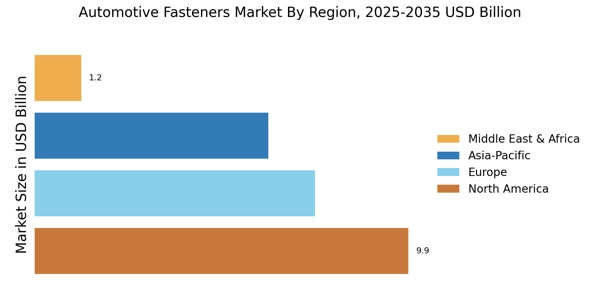

Identification of over 60 key manufacturers in the threaded fastener, cold-formed component, and specialty automotive fastening solutions sectors, with a focus on emerging markets, Asia-Pacific, Europe, and North America.

Product mapping for exotic materials (titanium, copper, Inconel), high-performance polymers, aluminum alloys, and steel grades (carbon steel, alloy steel, stainless steel) utilized in powertrain and chassis applications Analysis of annual revenues for automotive fastener portfolios, which include Body-in-White (BIW) structural fasteners, powertrain bolting systems, and interior decorative clips, as reported and modeled

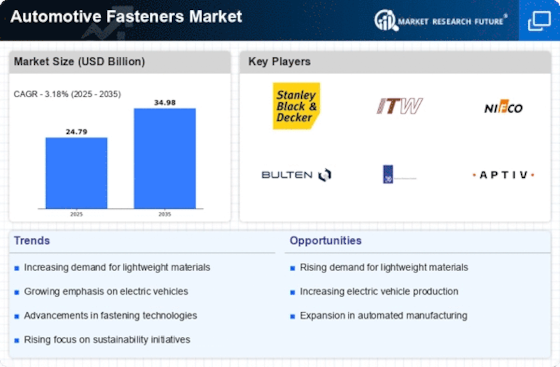

Coverage of manufacturers that accounted for 75-80% of the global market share in 2024, including key players (Stanley Black & Decker, ITW, Bulten, Nifco, Sundaram Fasteners) and regional specialists

Segment-specific valuations for passenger vehicles, commercial vehicles, and two-wheelers are derived through extrapolation using bottom-up (vehicle production volumes by country × Bill of Materials (BOM) fastener count × Average Selling Price by fastener type) and top-down (manufacturer revenue validation across bolts, nuts, screws, washers, and rivets) approaches.