塩素アルカリ市場 概要

MRFRの分析によると、塩素アルカリ市場の規模は2024年に59.21億米ドルと推定されています。塩素アルカリ産業は、2025年に63.06億米ドルから2035年までに118.39億米ドルに成長する見込みであり、2025年から2035年の予測期間中に年平均成長率(CAGR)は6.5%となる見込みです。

主要な市場動向とハイライト

塩素アルカリ市場は、持続可能性と技術の進歩によって成長する準備が整っています。

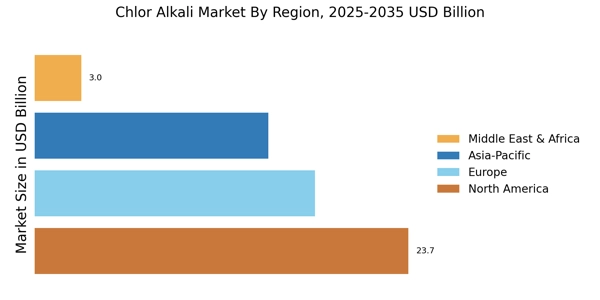

- "北米は塩素アルカリ製品の最大市場であり、堅調な産業需要を反映しています。

- アジア太平洋地域は、都市化と工業化の進展により、最も成長が早い地域として浮上しています。

- 塩素は最大のセグメントとして引き続き支配的であり、苛性ソーダは多様な用途により急速に成長しています。

- 塩素アルカリ製品の需要の高まりと環境基準に対する規制の支援が、市場を形成する重要な要因です。"

市場規模と予測

| 2024 Market Size | 59.21 (USD十億) |

| 2035 Market Size | 118.39 (USD十億) |

| CAGR (2025 - 2035) | 6.5% |

主要なプレーヤー

ダウ・ケミカル・カンパニー(米国)、オリン・コーポレーション(米国)、ウェストレイク・ケミカル・コーポレーション(米国)、信越化学工業株式会社(日本)、ソルベイS.A.(ベルギー)、トソー株式会社(日本)、アクゾノーベルN.V.(オランダ)、フォルモサ・プラスチックス・コーポレーション(台湾)、INEOS クロルビニル(イギリス)