To gather both qualitative and quantitative information, the primary research process involved interviewing players from both the supply and demand sides. Digital signage hardware, software, and system integrator CEOs, VPs, CTOs, and directors of commercial strategy were among the supply-side sources. Members on the demand side included chief information officers (CIOs), directors of information technology (IT), marketing (IM), procurement (PM), and operations (OS) from various sectors such as retail, hotel, corporate, healthcare, education, and transportation. Market segmentation, product development roadmaps, pricing strategies, deployment schedules, and return on investment indicators were all bolstered by primary research.

Primary Respondent Breakdown:

By Designation: C-level Primaries (32%), Director Level (30%), Others (38%)

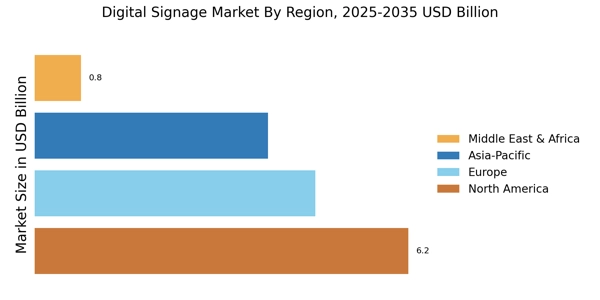

By Region: North America (38%), Europe (25%), Asia-Pacific (28%), Rest of World (9%)

Global market valuation was derived through revenue mapping and deployment volume analysis. The methodology included:

Identification of 50+ key manufacturers and solution providers across North America, Europe, Asia-Pacific, and Latin America

Product mapping across hardware (LED/LCD displays, OLED screens, media players, controllers), software (content management systems, digital signage analytics, audience measurement tools), and services (professional services, managed services, maintenance & support)

Analysis of reported and modeled annual revenues specific to digital signage portfolios

Coverage of manufacturers representing 65-70% of global market share in 2024

Extrapolation using bottom-up (deployment volume × ASP by country/vertical) and top-down (manufacturer revenue validation) approaches to derive segment-specific valuations