In the primary research phase, supply-side and demand-side stakeholders were interviewed to acquire qualitative and quantitative perspectives. Supply-side sources included CEOs, VPs of Technology Development, regulatory affairs heads, and commercial directors from renewable chemical producers, bio-refinery operators, and feedstock suppliers. Procurement directors from automakers, packaging producers, textile manufacturers, chemical formulators, and sustainability officials from Fortune 500 corporations were examples of demand-side suppliers. Market segmentation, capacity expansion schedules, feedstock sourcing tactics, offtake agreements, price volatility, and carbon credit monetization were all confirmed by primary research.

Primary Respondent Breakdown:

By Company Tier: Tier 1 (38%), Tier 2 (35%), Tier 3 (27%)

By Designation: C-level Primaries (32%), Director Level (31%), Others (37%)

By Region: North America (32%), Europe (30%), Asia-Pacific (28%), Rest of World (10%)

[Note: Tier 1 = >USD 10B revenue; Tier 2 = USD 1B-10B; Tier 3 =

Global market valuation was established using production capacity mapping and volume-demand research. The methodology comprised:

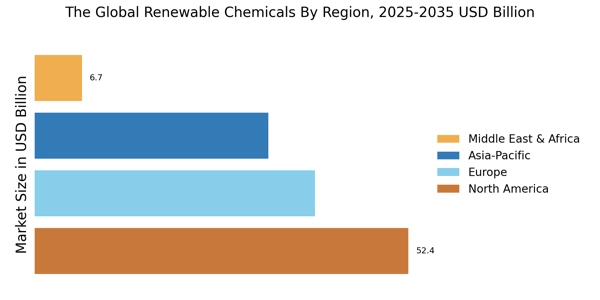

Identification of 50+ significant manufacturers in North America, Europe, Asia-Pacific, and Latin America

Product mapping spans ethanol, methanol, ketones, glycerol, organic acids, bio-polymers, platform chemicals, and other renewable chemical categories Examination of reported and projected yearly income for portfolios of renewable chemicals coverage of producers accounting for 65–70% of the world market in 2024

Extrapolation of segment-specific valuations utilizing top-down (manufacturer revenue validation) and bottom-up (production volume × ASP by region) methods