The secondary research process involved comprehensive analysis of mining regulatory databases, geological surveys, industrial mineral publications, and authoritative industry associations. Key sources included the US Geological Survey (USGS) Minerals Yearbook, US Mine Safety and Health Administration (MSHA), US Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA) Silica Standards, European Association of Industrial Silica Producers (EUROSIL), British Geological Survey (BGS), Industrial Minerals Association – North America (IMA-NA), National Industrial Sand Association (NISA), US Energy Information Administration (EIA), International Energy Agency (IEA), World Steel Association, Glass Manufacturing Industry Council (GMIC), American Foundry Society (AFS), China Ministry of Natural Resources, Geological Survey of Japan (GSJ), Australian Bureau of Statistics (ABS) Mining Data, Indian Bureau of Mines, Brazilian Mining Association (Ibram), World Bank Commodity Price Data, United Nations Industrial Development Organization (UNIDO), and national mining ministry reports from key producing regions.

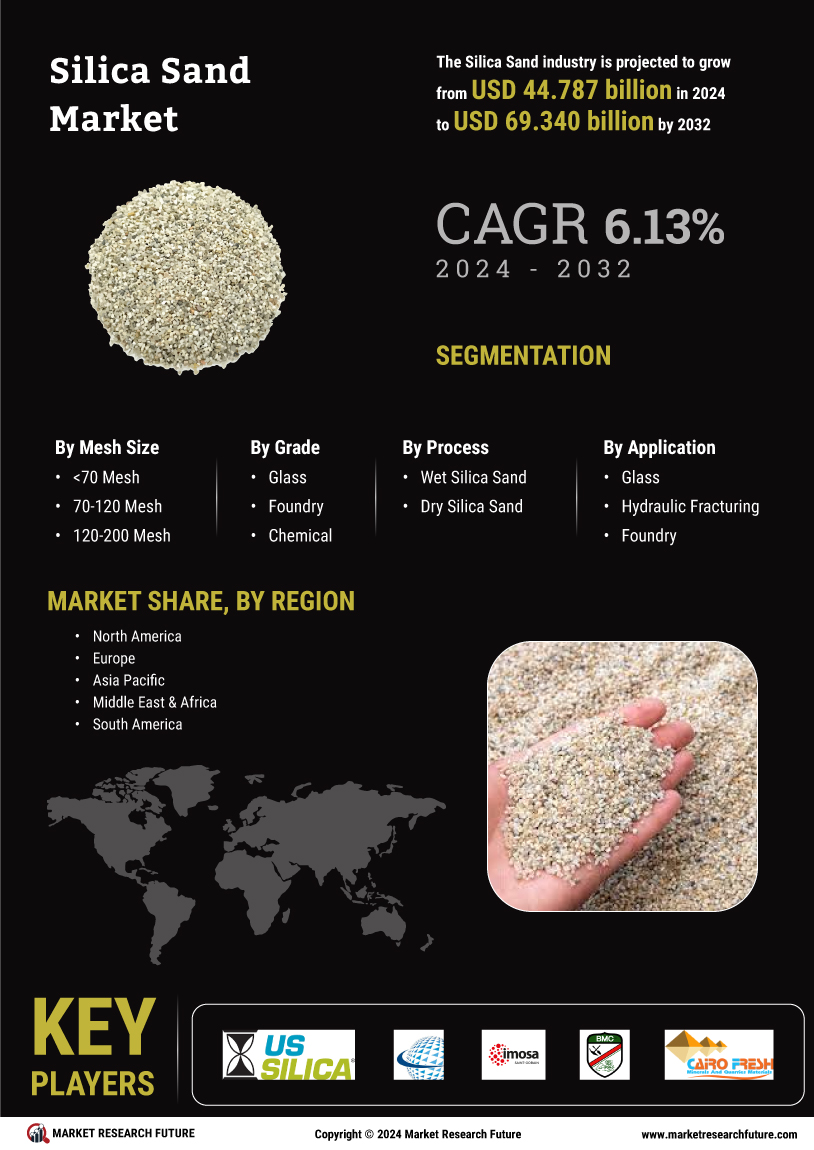

These sources were used to collect production statistics, reserve estimates, regulatory compliance data, trade flow analysis, and market landscape assessment for wet and dry silica sand across glass grade, foundry grade, and chemical grade categories, as well as mesh size segments (<70 mesh, 70-120 mesh, 120-200 mesh, and >200 mesh).