Market Share

3D Concrete Printing Market Share Analysis

To stand out in the fast-changing 3D Concrete Printing Market, organizations use a variety of methods. The strategy is to innovate 3D concrete printing technology. Companies invest in R&D to improve printing system efficiency, speed, and precision, focusing on design flexibility, sustainability, and concrete mix compatibility. Companies can attract clients seeking modern and sustainable approaches for residential and infrastructure construction by delivering cutting-edge solutions.

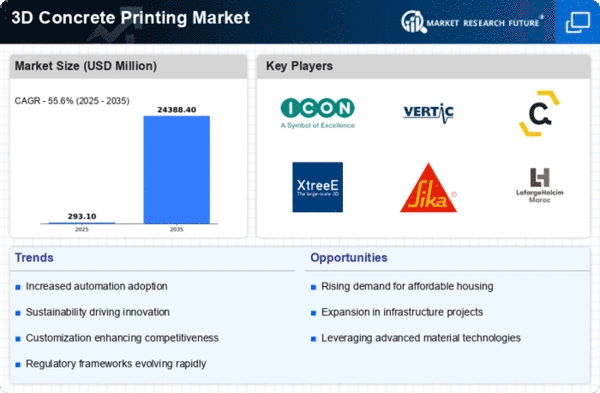

The 3D concrete printing market is expected to increase due to its rapid growth at a stable CAGR rate through 2028. Studies show that the market is demanding more personalized and cost-effective constructions, which will encourage producers to perform larger and more complex activities to suit diversification and expanding needs. The market is also seeing an increase in finances and investment for robust infrastructure that will help it expand and recover from the pandemic.

3D Concrete Printing Market share positioning depends on pricing tactics. Cost leadership companies provide 3D concrete printing at low prices to attract budget-conscious building organizations. Conversely, organizations that emphasize printing precision, customization, or automation use premium pricing tactics. This premium approach attracts consumers who seek top-tier 3D concrete printing solutions, increasing profit margins and value.

A large network is essential for market share positioning. To provide extensive 3D concrete printing, companies work with construction businesses, architects, and real estate developers. A well-organized distribution system increases market reach and makes novel technology accessible for clients to use when planning or executing construction projects. Accessibility influences buying decisions, so organizations position themselves to fulfill demand.

Strategic relationships and collaborations with construction and architectural leaders are also important for 3D Concrete Printing Market market share positioning. By partnering with design, engineering, and construction businesses, enterprises may share experience, reach new markets, and solve 3D concrete printing specifications and project requirements issues. Joint ventures, strategic acquisitions, and collaborations boost a 3D Concrete Printing Market company's market share and position.

Effective marketing and branding are key to market share growth. Digital marketing, construction events, and industry professional involvement help companies build brand awareness and promote 3D concrete printing services. A strong brand attracts new customers and earns architects, engineers, and construction managers' trust, strengthening a company's 3D concrete printing solutions market share.

Innovation drives market share in the 3D Concrete Printing Market. Companies invest in R&D to develop new printing technologies that meet construction, sustainability, and design trends. New printing materials, greater printing capabilities, or automation and robotics can make a company a leader in 3D concrete printing solutions.

Market share positioning also depends on customer-centric tactics. Company 3D concrete printing services and solutions are tailored to construction enterprises, architects, and project managers' demands. Excellent customer service, technical assistance, and smooth 3D printing integration into construction projects generate trust and long-term connections. Happy consumers are more likely to return, boosting a company's reputation and market share.

Leave a Comment