Market Trends

Key Emerging Trends in the 3D Concrete Printing Market

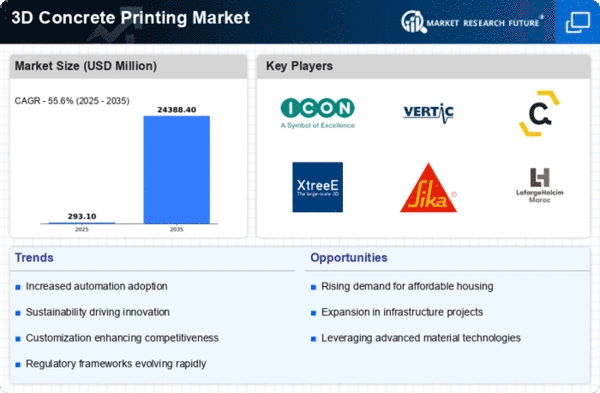

Transformative trends in 3D Concrete Printing indicate a paradigm shift in construction methods. This technology is attractive for complicated architectural forms and structures due to its speed, cost-effectiveness, and design freedom. The trend supports the construction industry's adoption of digital technologies and automation to boost efficiency and speed up construction.

Also growing is the market for eco friendly 3D concrete printing materials.3D concrete printing is eco friendly compared to traditional construction processes since it corresponds with global goals to lower the construction industry's carbon footprint.

Robotics and automation in 3D concrete printing are also affecting industry developments. Advanced robotic devices with advanced control algorithms deposit concrete precisely and efficiently, creating high-quality structures. Automation improves accuracy and scales 3D concrete printing for different-sized applications. This technological trend is projected to continue as researchers optimize robotic systems for performance and versatility.

The market for on-site 3D concrete printing is growing. On-site 3D printing reduces transportation expenses, material waste, and allows building site printing. This trend tackles logistical issues with delivering pre-printed components and shows that 3D concrete printing can be used for on-demand, bespoke building in different locations.

Market developments are shaped by government backing and regulatory activities for 3D concrete printing. Regional authorities recognize 3D printing's potential to alter the building industry by enhancing efficiency, decreasing waste, and enabling inventive design. Incentives, research money, and legal frameworks that enable 3D concrete printing in mainstream building are boosting adoption.

Standardized regulations, material optimization, and construction industry distrust remain hurdles. For safety, quality, and conformity with construction requirements, 3D concrete printing processes and structures need defined codes and laws. Research is also refining 3D printing materials for longevity, structural integrity, and printing system compatibility. To overcome industry pessimism regarding long-term performance and reliability, 3D concrete printing needs continuing education, collaboration, and successful demonstration projects.

Leave a Comment