Research Methodology on Aircraft Tire Retreading Market

1 . Introduction:

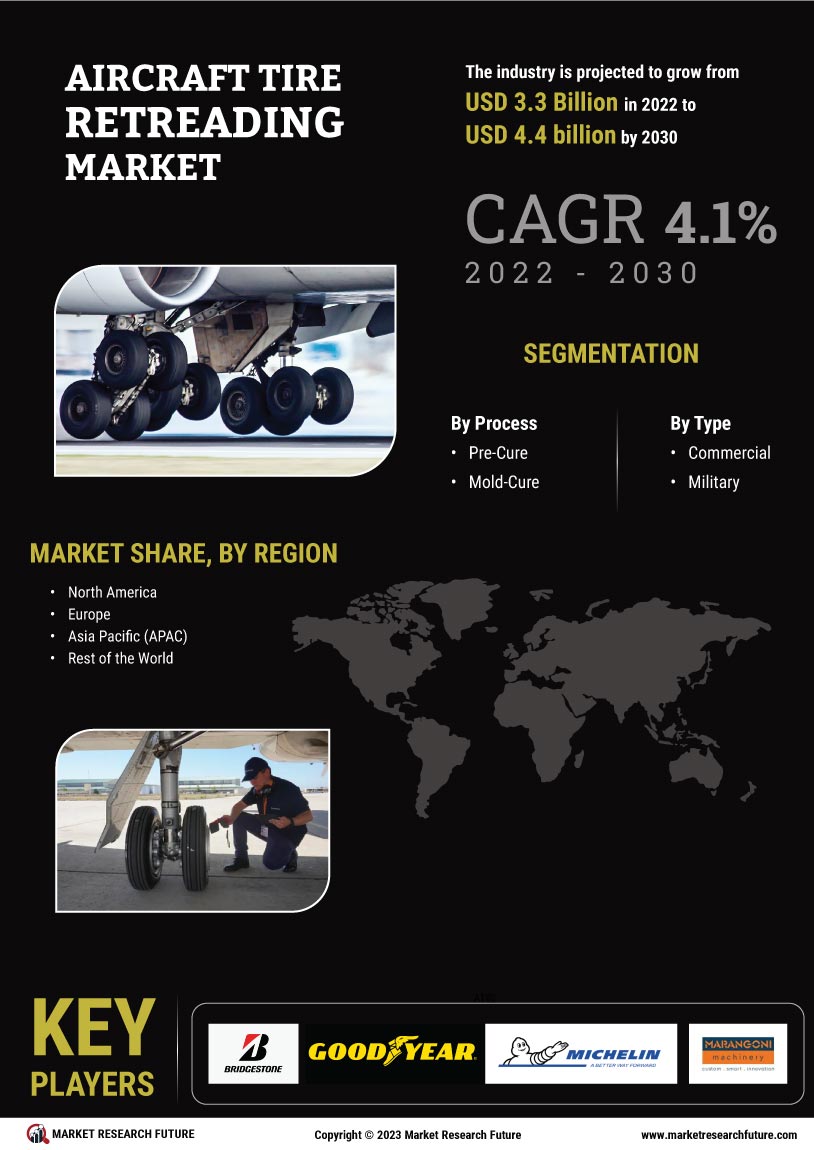

This research report is aimed at analyzing the aircraft tire retreading market. Aircraft tyres are exposed to considerable wear and tear and are exposed to hazards while they are in use. Thus, they need to be inspected and maintained regularly to avoid accidents caused due to malfunctioning of these tyres. The re-treading of aircraft tyres helps in maintaining the tires for use for a longer period of time, thus saving costs and resources associated with buying new tyres. The market for aircraft tire retreading is projected to increase in size from 2023 to 2030 and this report is intended to analyze the factors affecting the market, the strategies of the players in the market and their current financial standing.

2. Research Objectives:

This research seeks to examine the following research objectives:

- To analyze the global market for aircraft tire retreading services.

- To identify the major market players and analyze their product portfolios and financial data.

- To discuss the various strategies adopted by the players in the market.

- To examine the current market trends and assess the future growth prospects of the market.

3. Research Design

This research design is descriptive in nature. The data for this research is collected from both primary and secondary sources. Primary sources include industry interviews, surveys and analysis. Secondary sources include company reports, journals, articles, press releases, industry databases and survey websites. To evaluate and predict the potential of the market both qualitative and quantitative approaches are used.

4. Data Collection

This research makes use of both primary and secondary sources of data. The primary data is gathered through structured interviews with industry professionals and surveys that were conducted online. The online survey is conducted with a sample size of 300 respondents and is administered via a questionnaire. The questions focus on understanding the current market dynamics, industry trends and future growth prospects. The responses to the questions were then analyzed and tabulated. The secondary data is gathered through the Internet, databases, books, industry contacts and reports.

5. Data Analysis

The primary and secondary data collected are analyzed and interpreted using descriptive, quantitative and qualitative methods. The quantitative approach involves the use of parametric and non-parametric tests to assess the impact of the various market factors on the overall industry. The qualitative approach involves the in-depth analysis of the data collected to identify the current trends and the growth potential of the market.

6. Scope of the Study

The scope of this study is limited to the analysis of the aircraft tire retreading market. MRFR will assess the impact of the various market drivers and challenges on the growth of the industry. It will also examine the strategies adopted by the major market players and assess their financial standing.

7. Conclusions

In conclusion, this research analyzes the aircraft tire retreading market to understand its market conditions and trends. The data collected is analyzed using both qualitative and quantitative methods. The analysis has revealed that the current market is highly competitive, with a few major players dominating the market. The report also identifies the major market drivers and challenges. Additionally, the report provides insights into the strategies adopted by the major players in the market.