Research Methodology on Antimicrobial Plastics Market

Introduction

The global antimicrobial plastics market is expected to grow significantly over the course of the next seven years. Antimicrobial plastics are material-based products that are produced from either organic or inorganic components and have higher resistance to microbial degradation. These plastics are commonly used in packaging and plastic food containers, due to their effects in limiting the growth of microorganisms. This new type of plastic is proving to be a cost-effective and versatile solution for addressing public health issues related to microbial contamination.

The purpose of this research is to investigate the production, use, and sales of antimicrobial plastics and the key drivers of their growth. Specifically, it seeks to identify the main markets, producers, and consumers of antimicrobial plastics; analyze the benefits and challenges associated with the use of this technology; and offer insights into the opportunities and limitations for the growth of the antimicrobial plastics market.

Research Methodology

To understand the dynamics of the antimicrobial plastics market and gain valuable insights, a comprehensive research methodology is required. The research design includes the use of both primary and secondary data, with a particular emphasis on quantitative and qualitative methods along with the market forecast from 2023 to 2030.

Primary Data

Primary data collection will involve the direct investigation and observation of users, suppliers and retailers of antimicrobial plastic goods. Efforts will be made to gain insight into their attitudes, opinions, and experiences with the product. Primary data collection methods include interviews, surveys, and observations. Interviews will be used as the primary means of gaining qualitative data from the key market participants, while surveys will be used to obtain quantifiable metrics.

Secondary Data

Secondary data collection involves the gathering and synthesis of data from existing research documents, trade and industry journals, government reports, and business websites. This will provide insight into the dynamics of the market including demand and supply patterns, operational metrics, and distribution networks. Data will be retrieved from published reports, web-based databases, and public periodicals.

Analytical Methods

Analysis of the gathered data will involve the use of multiple analytical techniques. Descriptive analysis will be used to draw out key attributes of the market including product types, distribution routes, and key trends. The cross-sectional analysis will be used to compare commodities, as well as the average prices in different markets. In addition, trend analysis will be used to identify long-term growth patterns. Cluster analysis will be used to categorize the distribution of the market based on geography, size, and type of business.

Data Screening

The obtained data will be subject to rigorous verification and quality control. To ensure the accuracy and reliability of the data, a range of screening procedures will be used. These can include tests such as conferencing, editing, and consistency checks.

Data Analysis

Data analysis will be conducted using standard statistical techniques that incorporate a combination of univariate, bivariate, and multivariate methods. This will enable the researcher to draw meaningful inferences from the gathered data. In addition, the analysis will use graphical tools such as charts and graphs to visualize the data.

Reporting

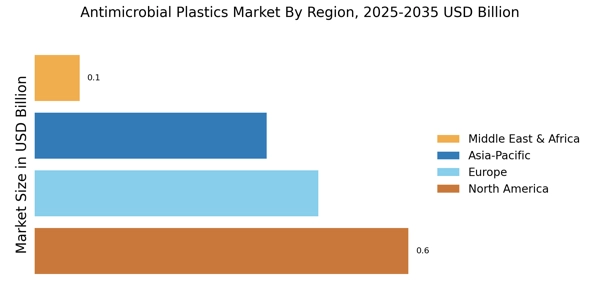

The collected data will be presented in the form of a comprehensive report, which will provide an in-depth look into the global antimicrobial plastics market. This report will include an executive summary, an analysis of the market dynamics, a segmentation of the market, and a regional breakdown. The report will also include the findings of the primary and secondary data collection, the analysis of key stakeholders, and the conclusions of the research.