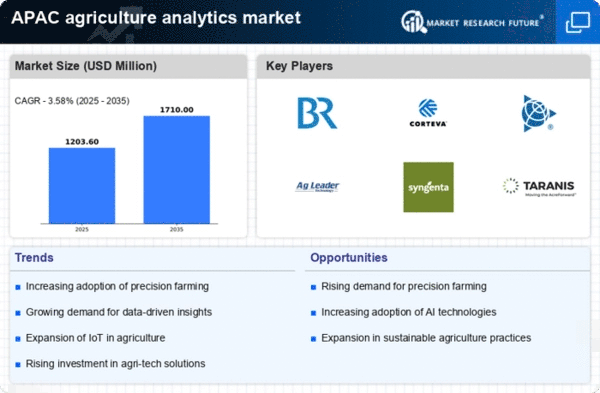

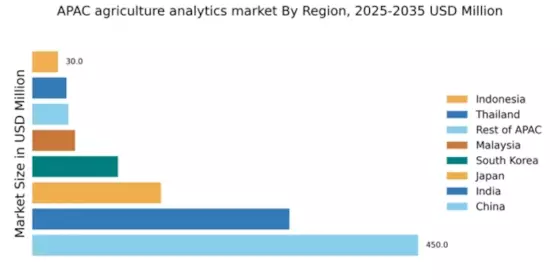

China : Leading in Innovation and Investment

China holds a commanding market share of 45% in the agriculture analytics sector, valued at $450.0 million. Key growth drivers include rapid technological advancements, increased investment in precision agriculture, and government initiatives promoting sustainable farming practices. Demand trends show a shift towards data-driven decision-making among farmers, supported by favorable regulatory policies aimed at enhancing agricultural productivity. Infrastructure development, particularly in rural areas, is also a significant factor driving market growth.

India : Harnessing Technology for Farmers

India's agriculture analytics market is valued at $300.0 million, accounting for 30% of the APAC market. The growth is driven by increasing smartphone penetration, government support for digital agriculture, and rising awareness of data analytics among farmers. Consumption patterns indicate a growing preference for mobile-based solutions that provide real-time insights. Regulatory initiatives, such as the Digital India program, are fostering a conducive environment for technology adoption in agriculture.

Japan : Precision Farming Takes Center Stage

Japan's agriculture analytics market is valued at $150.0 million, representing 15% of the APAC market. The sector is characterized by high adoption rates of precision farming technologies, driven by the need for efficiency and sustainability. Demand trends show a focus on data integration and IoT applications in agriculture. Government policies promoting smart agriculture and research initiatives are crucial in supporting market growth, alongside robust infrastructure in rural areas.

South Korea : Embracing Smart Farming Technologies

South Korea's agriculture analytics market is valued at $100.0 million, making up 10% of the APAC market. Key growth drivers include government initiatives supporting smart farming and increasing investment in agricultural technology startups. Demand trends reflect a shift towards automated solutions and data analytics for crop management. The government’s Green New Deal is enhancing infrastructure and promoting sustainable practices, creating a favorable business environment for tech adoption.

Malaysia : Growing Adoption of Analytics Solutions

Malaysia's agriculture analytics market is valued at $50.0 million, representing 5% of the APAC market. The growth is fueled by increasing awareness of data-driven farming and government initiatives aimed at enhancing agricultural productivity. Demand trends indicate a rising interest in precision agriculture technologies among local farmers. Regulatory support, such as the National Agro-Food Policy, is fostering a conducive environment for innovation and investment in agri-tech solutions.

Thailand : Focus on Sustainable Farming Practices

Thailand's agriculture analytics market is valued at $40.0 million, accounting for 4% of the APAC market. The growth is driven by increasing government support for sustainable agriculture and rising demand for data analytics among farmers. Consumption patterns show a preference for solutions that enhance crop yield and resource management. The Thai government’s initiatives, such as the Agricultural Development Plan, are crucial in promoting technology adoption in the sector.

Indonesia : Potential for Growth and Innovation

Indonesia's agriculture analytics market is valued at $30.0 million, representing 3% of the APAC market. Key growth drivers include increasing smartphone usage among farmers and government initiatives promoting digital agriculture. Demand trends indicate a growing interest in mobile applications for farm management. The government’s support for agricultural innovation, alongside infrastructure improvements, is creating a favorable environment for the growth of agri-tech solutions.

Rest of APAC : Varied Market Dynamics Across Regions

The Rest of APAC agriculture analytics market is valued at $42.0 million, accounting for 4% of the overall market. This sub-region showcases diverse growth drivers, including varying levels of technology adoption and government support across countries. Demand trends reflect a mix of traditional and modern farming practices, with some regions embracing digital solutions faster than others. Local market dynamics are influenced by unique agricultural practices and regulatory environments, creating varied opportunities for market players.