Increasing Demand for Food Security

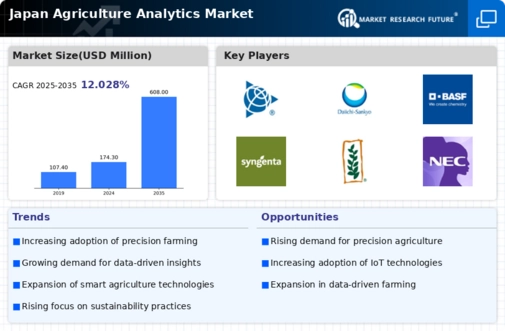

Japan's agriculture analytics market is significantly influenced by the rising demand for food security. With a growing population and limited arable land, there is an urgent need for efficient agricultural practices. Analytics tools help optimize resource allocation, monitor crop performance, and predict yields, which are crucial for ensuring food supply stability. Reports indicate that the market for agriculture analytics in Japan could reach approximately $500 million by 2027, reflecting the critical role of data-driven solutions in enhancing food production and sustainability.

Technological Advancements in Agriculture

The The market in Japan is experiencing a surge due to rapid technological advancements. in Japan is experiencing a surge due to rapid technological advancements. Innovations such as IoT devices, drones, and AI-driven analytics are transforming traditional farming practices. These technologies enable farmers to collect and analyze data on crop health, soil conditions, and weather patterns, leading to improved decision-making. For instance, the integration of precision farming tools has been shown to increase crop yields by up to 20%. As farmers increasingly adopt these technologies, the demand for sophisticated analytics solutions is likely to grow, driving the agriculture analytics market forward.

Focus on Sustainable Agricultural Practices

Sustainability is becoming a pivotal concern within the agriculture analytics market in Japan. As environmental issues gain prominence, farmers are seeking analytics solutions that promote sustainable practices. These tools assist in monitoring environmental impact, optimizing input usage, and enhancing crop resilience. The shift towards sustainable agriculture is not only beneficial for the environment but also aligns with consumer preferences for eco-friendly products. Consequently, the agriculture analytics market is likely to see increased investment in solutions that support sustainable farming, potentially leading to a market valuation of $600 million by 2028.

Rising Adoption of Smart Farming Techniques

The agriculture analytics market is witnessing a notable shift towards smart farming techniques in Japan. Farmers are increasingly utilizing data analytics to enhance productivity and sustainability. Smart farming encompasses the use of sensors, GPS technology, and data analytics to monitor and manage agricultural operations. This trend is expected to grow, as it allows for precise resource management, reducing waste and increasing efficiency. The agriculture analytics market is projected to expand as more farmers recognize the benefits of these technologies, potentially leading to a market growth rate of 15% annually.

Government Initiatives for Agricultural Innovation

Government initiatives aimed at fostering agricultural innovation are significantly impacting the agriculture analytics market in Japan. Policies that promote research and development in agricultural technologies are encouraging the adoption of analytics solutions among farmers. Financial incentives and grants for technology implementation are also contributing to market growth. The Japanese government has set ambitious goals for agricultural productivity, which necessitates the integration of data analytics into farming practices. As a result, the agriculture analytics market is expected to benefit from these supportive measures, with projections indicating a compound annual growth rate of 12% over the next five years.