Focus on Climate Resilience

The agriculture analytics market is also influenced by the increasing focus on climate resilience in France. As climate change poses significant challenges to agricultural productivity, farmers are turning to analytics to develop adaptive strategies. By utilizing predictive analytics, farmers can anticipate climate-related risks and implement measures to mitigate their impact. This proactive approach is essential for maintaining crop yields and ensuring food security. The French Ministry of Agriculture has emphasized the need for climate-smart agriculture, which is likely to drive demand for analytics solutions. As a result, the agriculture analytics market is expected to grow, with an emphasis on tools that support sustainable practices and enhance resilience against climate variability.

Rising Demand for Food Security

Food security remains a pressing concern in France, driving the agriculture analytics market. With a growing population and changing dietary preferences, the need for efficient food production systems is paramount. Agriculture analytics provides insights that help optimize production processes, reduce waste, and enhance supply chain efficiency. Reports indicate that the French government aims to increase food production by 30% by 2030, necessitating the adoption of analytics solutions. This demand for food security is likely to propel investments in agriculture analytics, as stakeholders seek to leverage data for better forecasting and resource management. Consequently, the agriculture analytics market is expected to expand, with a focus on sustainable practices that ensure long-term food availability.

Increased Investment in Smart Farming

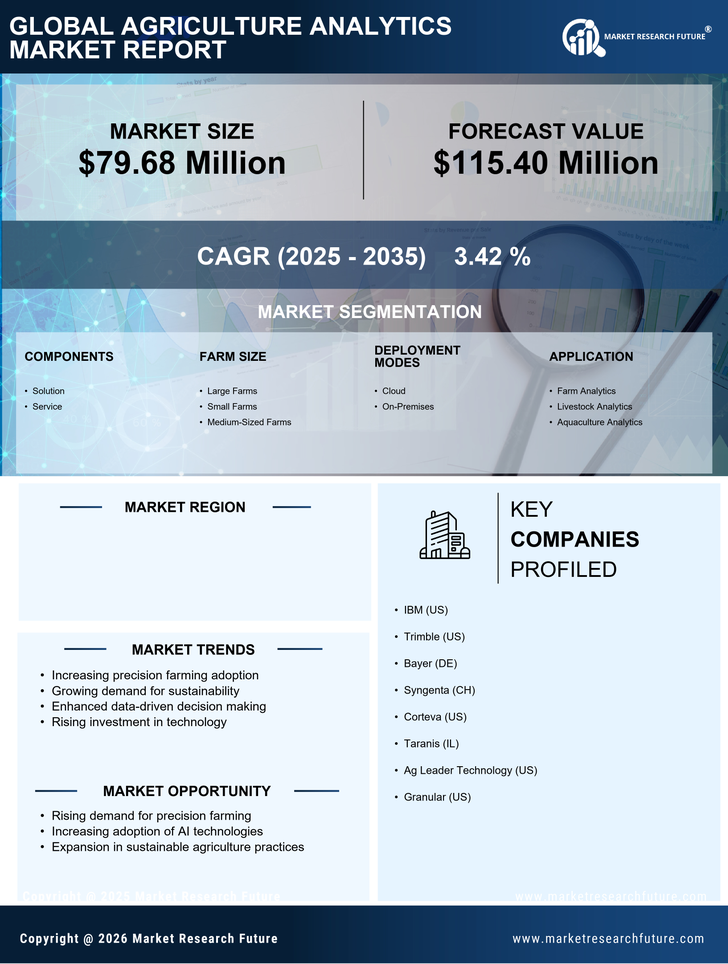

Investment in smart farming technologies is a key driver of the agriculture analytics market in France. Farmers are increasingly recognizing the value of integrating IoT devices and sensors into their operations. These technologies facilitate real-time data collection, enabling farmers to monitor soil health, weather conditions, and crop performance. The French government has allocated €200 million to support the development of smart farming initiatives, which is likely to stimulate further growth in the agriculture analytics market. As these investments materialize, the market is expected to witness a compound annual growth rate (CAGR) of 15% over the next five years, reflecting the growing importance of data-driven decision-making in agriculture.

Growing Awareness of Sustainable Practices

There is a growing awareness of sustainable agricultural practices among French farmers, which is positively impacting the agriculture analytics market. As consumers increasingly demand sustainably produced food, farmers are seeking ways to minimize their environmental footprint. Agriculture analytics provides valuable insights into resource usage, enabling farmers to optimize inputs such as water and fertilizers. This shift towards sustainability is supported by various initiatives, including the European Union's Green Deal, which aims to promote environmentally friendly farming practices. The agriculture analytics market is likely to benefit from this trend, as farmers adopt analytics tools to enhance sustainability and meet regulatory requirements, potentially leading to a market growth of 12% by 2026.

Technological Advancements in Data Analytics

The agriculture analytics market in France is experiencing a surge due to rapid technological advancements in data analytics. Innovations in machine learning and artificial intelligence are enabling farmers to analyze vast amounts of data efficiently. This capability allows for improved decision-making regarding crop management, pest control, and resource allocation. According to recent studies, the integration of advanced analytics tools can enhance crop yields by up to 20%. As farmers increasingly adopt these technologies, the agriculture analytics market is projected to grow significantly, with an estimated value reaching €1.5 billion by 2027. This growth reflects a broader trend towards data-driven farming practices, which are becoming essential for maintaining competitiveness in the agricultural sector.