Rising Demand for Food Security

The agriculture analytics market is significantly influenced by the rising demand for food security in the GCC. As populations grow and urbanization increases, the pressure on agricultural systems intensifies. The region's governments are prioritizing food security, which necessitates the adoption of advanced analytics to monitor crop health, soil conditions, and weather patterns. The market is projected to grow by 15% annually as stakeholders seek to leverage data analytics for better resource allocation and risk management. This trend indicates a shift towards more resilient agricultural practices, where analytics play a crucial role in ensuring that food supply meets the increasing demand.

Government Initiatives and Support

Government initiatives play a pivotal role in shaping the agriculture analytics market. In the GCC, various governments are investing in agricultural technology to enhance food security and sustainability. For example, initiatives aimed at promoting smart farming practices are gaining traction, with funding allocated for research and development. The agriculture analytics market is expected to benefit from these policies, as they encourage the adoption of data analytics tools among farmers. Reports indicate that government funding in the region could reach $500 million by 2026, aimed at fostering innovation in agricultural practices. This support not only boosts the market but also aligns with national goals of achieving self-sufficiency in food production.

Climate Change and Environmental Concerns

Climate change poses a substantial challenge to agriculture in the GCC, prompting a shift towards analytics-driven solutions. The agriculture analytics market is responding to the need for adaptive strategies that mitigate the impacts of climate variability. Farmers are increasingly utilizing data analytics to optimize water usage and manage soil health, which is critical in arid regions. The market is expected to grow as more stakeholders recognize the importance of sustainable practices. Reports suggest that investments in climate-smart agriculture could exceed $300 million by 2027, highlighting the potential for analytics to drive environmental sustainability in the sector.

Technological Advancements in Agriculture

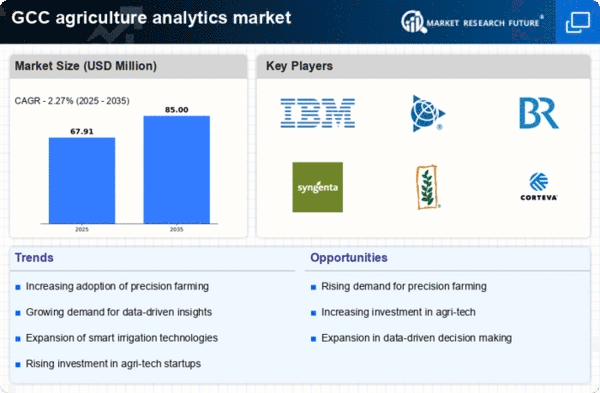

The agriculture analytics market is experiencing a surge due to rapid technological advancements. Innovations such as machine learning, artificial intelligence, and remote sensing are transforming traditional farming practices. In the GCC, the integration of these technologies is enhancing crop yield predictions and resource management. For instance, the market for precision agriculture tools is projected to grow at a CAGR of 12% from 2025 to 2030. This growth is driven by the need for data-driven decision-making in agriculture, which is crucial for optimizing inputs and maximizing outputs. As farmers increasingly adopt these technologies, the agriculture analytics market is likely to expand significantly, providing insights that lead to improved productivity and sustainability.

Increased Investment in Agricultural Technology

Investment in agricultural technology is a key driver of the agriculture analytics market. In the GCC, venture capital and private equity are increasingly flowing into agri-tech startups focused on data analytics solutions. This influx of capital is fostering innovation and the development of new tools that enhance productivity and efficiency. The agriculture analytics market is projected to see a growth rate of 10% annually as these technologies become more accessible to farmers. The trend indicates a shift towards a more data-centric approach in agriculture, where analytics are integral to decision-making processes, ultimately leading to improved agricultural outcomes.