Growing Focus on Crop Health Monitoring

The agriculture analytics market in Canada is increasingly focused on crop health monitoring, driven by the need for improved agricultural productivity. Farmers are utilizing analytics tools to monitor crop conditions, detect diseases, and optimize inputs such as water and fertilizers. Recent studies indicate that the use of analytics for crop health monitoring can lead to yield increases of up to 20%. This trend highlights the potential of the agriculture analytics market to transform traditional farming practices into more data-centric approaches. By leveraging analytics, farmers can make timely interventions, ultimately enhancing crop resilience and sustainability in the face of changing climatic conditions.

Government Support and Funding Initiatives

Government initiatives play a crucial role in shaping the agriculture analytics market in Canada. Various funding programs and grants are available to support the adoption of advanced analytics technologies among farmers. For instance, the Canadian government has allocated over $100 million to promote innovation in agriculture, which includes investments in data analytics tools. This financial backing encourages farmers to embrace analytics solutions, thereby enhancing their competitiveness in the market. The agriculture analytics market benefits from such government support, as it fosters an environment conducive to technological advancement and encourages the development of new analytics applications tailored to the unique needs of Canadian agriculture.

Integration of IoT and Sensor Technologies

The integration of Internet of Things (IoT) and sensor technologies is revolutionizing the agriculture analytics market in Canada. These technologies enable real-time data collection from fields, providing farmers with valuable insights into soil conditions, moisture levels, and weather patterns. As of November 2025, it is estimated that over 30% of Canadian farms have adopted IoT solutions to enhance their operational efficiency. This integration not only streamlines data collection but also facilitates predictive analytics, allowing farmers to anticipate challenges and optimize their practices accordingly. The agriculture analytics market is likely to see continued growth as more farmers recognize the benefits of IoT in enhancing productivity and sustainability.

Increased Awareness of Climate Change Impacts

The agriculture analytics market in Canada is increasingly influenced by the growing awareness of climate change impacts on farming practices. Farmers are seeking analytics solutions that help them adapt to changing weather patterns and mitigate risks associated with climate variability. Recent surveys indicate that approximately 70% of Canadian farmers are concerned about the effects of climate change on their operations. This heightened awareness drives demand for analytics tools that provide insights into climate trends and their potential impacts on crop yields. The agriculture analytics market is poised to respond to this demand by offering innovative solutions that assist farmers in developing resilient strategies to cope with climate-related challenges.

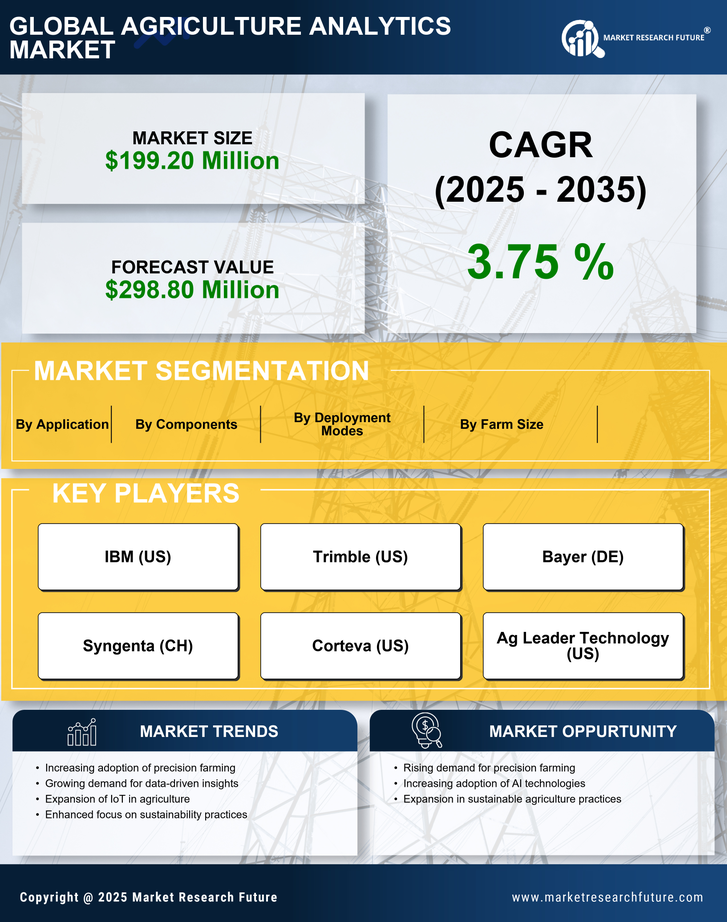

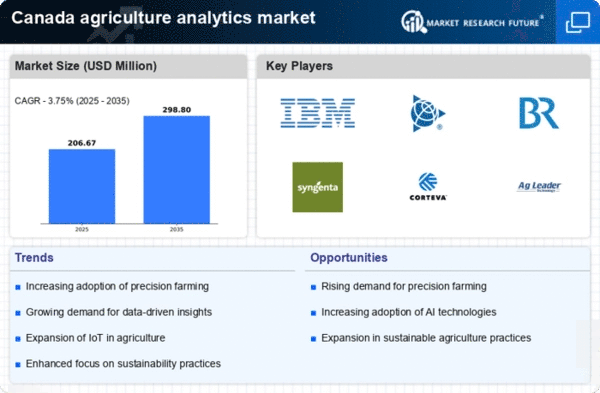

Rising Demand for Data-Driven Decision Making

The agriculture analytics market in Canada is experiencing a notable surge in demand for data-driven decision-making tools. Farmers and agribusinesses are increasingly recognizing the value of analytics in optimizing crop yields and resource management. According to recent statistics, approximately 60% of Canadian farmers are now utilizing some form of data analytics to enhance their operational efficiency. This trend is likely to continue as the agriculture analytics market evolves, providing innovative solutions that enable stakeholders to make informed decisions based on real-time data. The integration of analytics into farming practices not only improves productivity but also contributes to sustainable agricultural practices, aligning with the growing emphasis on environmental stewardship.