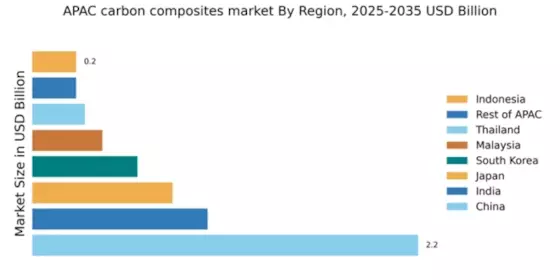

China : Unmatched Growth and Innovation

Key markets include cities like Shanghai, Beijing, and Shenzhen, which are hubs for technology and manufacturing. The competitive landscape features major players such as Toray Industries and SGL Carbon, which dominate the market with innovative products. Local dynamics are characterized by a strong emphasis on R&D and collaboration between industry and academia, particularly in sectors like aerospace and automotive, where carbon composites are increasingly utilized.

India : Rapid Growth in Diverse Sectors

Key markets include Maharashtra, Tamil Nadu, and Karnataka, where industrial hubs are rapidly developing. The competitive landscape features players like Hexcel Corporation and Teijin Limited, which are establishing a foothold in the region. Local market dynamics are influenced by a burgeoning startup ecosystem focused on innovation, particularly in automotive and aerospace applications, where carbon composites are gaining traction.

Japan : Technological Advancements Drive Growth

Key markets include Tokyo, Aichi, and Osaka, which are centers for automotive and aerospace industries. The competitive landscape is dominated by local giants like Mitsubishi Chemical and Toray Industries, known for their cutting-edge technologies. The business environment is favorable, with strong collaboration between industry and academia, particularly in sectors where carbon composites are essential for performance and sustainability.

South Korea : Aerospace and Automotive Focus

Key markets include Seoul and Busan, which are pivotal for industrial growth. The competitive landscape features major players like SGL Carbon and BASF SE, which are expanding their presence in the region. Local dynamics are characterized by a strong focus on innovation and collaboration, particularly in sectors where carbon composites are utilized for weight reduction and performance enhancement.

Malaysia : Strategic Location and Development

Key markets include Selangor and Penang, which are industrial hotspots. The competitive landscape features players like Solvay S.A. and Teijin Limited, which are establishing operations in the region. Local market dynamics are influenced by a focus on innovation and collaboration, particularly in sectors where carbon composites are essential for performance and sustainability.

Thailand : Automotive and Aerospace Growth

Key markets include Bangkok and Chonburi, which are central to industrial growth. The competitive landscape features players like Cytec Industries and Zoltek Companies, which are expanding their presence in the region. Local dynamics are characterized by a strong emphasis on innovation and collaboration, particularly in sectors where carbon composites are utilized for weight reduction and performance enhancement.

Indonesia : Focus on Sustainable Materials

Key markets include Jakarta and Surabaya, which are pivotal for industrial growth. The competitive landscape features emerging players and local manufacturers looking to capitalize on the growing demand. Local market dynamics are influenced by a burgeoning startup ecosystem focused on innovation, particularly in automotive applications where carbon composites are gaining traction.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include emerging economies in Southeast Asia and the Pacific Islands, where local players are beginning to establish a presence. The competitive landscape is fragmented, with various small to medium enterprises entering the market. Local dynamics are influenced by unique challenges, including varying levels of technological advancement and regulatory support, particularly in sectors where carbon composites are utilized for performance enhancement.