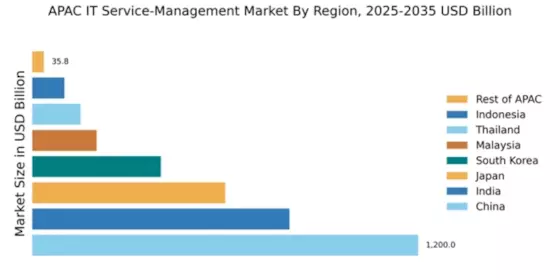

China : Robust Growth Driven by Innovation

Key markets include major cities like Beijing, Shanghai, and Shenzhen, which are hubs for technology and innovation. The competitive landscape features strong players such as ServiceNow, IBM, and local firms like Alibaba Cloud. The business environment is characterized by a mix of established corporations and emerging startups, driving innovation in sectors like finance, healthcare, and manufacturing. The focus on AI and automation in service management is reshaping industry standards and practices.

India : Emerging Hub for Innovation

Key markets include Bengaluru, Hyderabad, and Pune, known for their tech-savvy workforce and vibrant startup culture. The competitive landscape features major players like Freshworks and ManageEngine, alongside global giants like IBM and ServiceNow. The business environment is dynamic, with a focus on IT services across sectors such as e-commerce, finance, and healthcare. The rise of remote work has further accelerated the demand for effective service management solutions.

Japan : Technological Advancements Drive Demand

Key markets include Tokyo, Osaka, and Nagoya, which are central to Japan's technological landscape. The competitive landscape is dominated by local players like Fujitsu and NEC, alongside international firms such as IBM and ServiceNow. The business environment is characterized by a focus on quality and reliability, with significant investments in sectors like automotive, manufacturing, and finance. The integration of advanced technologies is reshaping service management practices across industries.

South Korea : Innovation and Technology Adoption

Key markets include Seoul and Busan, which are at the forefront of technological advancements. The competitive landscape features major players like Samsung SDS and LG CNS, alongside global firms such as ServiceNow and BMC Software. The business environment is vibrant, with a strong emphasis on sectors like telecommunications, finance, and manufacturing. The push for smart city initiatives is further driving the demand for effective IT service management solutions.

Malaysia : Strategic Location for IT Services

Key markets include Kuala Lumpur and Penang, which are emerging as tech hubs. The competitive landscape features local players like Fusionex and global firms such as IBM and ServiceNow. The business environment is conducive to growth, with a focus on sectors like finance, healthcare, and manufacturing. The government's commitment to enhancing digital infrastructure is further propelling the demand for IT service management solutions.

Thailand : Focus on Digital Transformation

Key markets include Bangkok and Chiang Mai, which are central to Thailand's tech ecosystem. The competitive landscape features local firms like Advanced Info Service and global players such as ServiceNow and BMC Software. The business environment is dynamic, with a focus on sectors like tourism, finance, and retail. The increasing emphasis on e-commerce is further driving the demand for effective IT service management solutions.

Indonesia : Growth Driven by Digital Initiatives

Key markets include Jakarta and Surabaya, which are pivotal to Indonesia's digital landscape. The competitive landscape features local players like Telkom Indonesia and global firms such as ServiceNow and IBM. The business environment is evolving, with a focus on sectors like e-commerce, finance, and telecommunications. The increasing adoption of mobile technology is further driving the demand for IT service management solutions.

Rest of APAC : Varied Markets with Unique Needs

Key markets include emerging economies in Southeast Asia and the Pacific Islands, each with unique characteristics. The competitive landscape features a mix of local and international players, including ServiceNow and Zendesk. The business environment is characterized by varying levels of technological adoption, with sectors like agriculture, finance, and tourism driving demand for IT service management solutions. The focus on sustainable development is also shaping market dynamics.