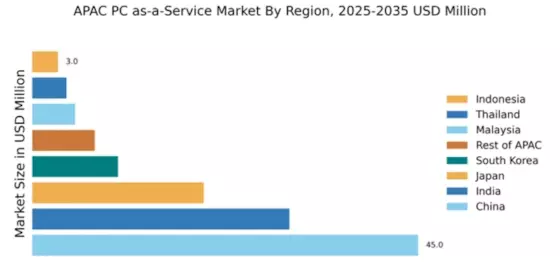

China : Unmatched Growth and Innovation

Key cities like Beijing, Shanghai, and Shenzhen are pivotal in the PCaaS landscape, hosting major tech firms and startups. The competitive landscape features significant players such as Lenovo, Dell Technologies, and Hewlett Packard Enterprise, all vying for market share. The business environment is characterized by a strong emphasis on innovation and collaboration, with local enterprises increasingly adopting PCaaS for sectors like education, finance, and healthcare. This trend is reshaping the IT procurement process across industries.

India : Transforming Business Landscapes

Cities such as Bengaluru, Hyderabad, and Mumbai are at the forefront of the PCaaS market, serving as hubs for technology and innovation. The competitive landscape is vibrant, with major players like Dell Technologies, Lenovo, and Microsoft establishing strong footholds. Local dynamics favor startups and SMEs, which are increasingly leveraging PCaaS to remain competitive. Industries such as IT, finance, and education are leading the charge in adopting these services, reshaping the business environment.

Japan : Tech-Driven Market Dynamics

Tokyo and Osaka are key markets, hosting numerous multinational corporations and tech startups. The competitive landscape features major players like Fujitsu and IBM, alongside global giants such as Dell Technologies. The business environment is marked by a focus on high-quality service delivery and customer satisfaction. Industries such as automotive, manufacturing, and finance are increasingly adopting PCaaS, driving innovation and efficiency in their operations.

South Korea : Strong Demand and Innovation

Seoul and Busan are pivotal markets, with a concentration of tech firms and startups. The competitive landscape includes major players like Samsung and LG, alongside global companies such as Microsoft and Cisco Systems. The local market dynamics favor innovation and collaboration, with businesses increasingly adopting PCaaS to stay competitive. Key sectors driving adoption include education, healthcare, and finance, reshaping the IT landscape in the region.

Malaysia : Strategic Market Developments

Kuala Lumpur and Penang are key markets, hosting numerous tech firms and startups. The competitive landscape features local players alongside global giants like Dell Technologies and Hewlett Packard Enterprise. The business environment is characterized by a focus on innovation and collaboration, with local enterprises increasingly adopting PCaaS for sectors like education, finance, and manufacturing. This trend is reshaping the IT procurement process across industries.

Thailand : Market Growth and Opportunities

Bangkok and Chiang Mai are key markets, with a growing number of tech startups and SMEs. The competitive landscape includes local players and global companies like Microsoft and IBM, all vying for market share. The local business environment is characterized by a focus on innovation and collaboration, with sectors such as retail, finance, and education leading the charge in adopting PCaaS. This trend is reshaping the IT landscape in Thailand.

Indonesia : Growth Driven by Digital Initiatives

Jakarta and Surabaya are key markets, with a growing number of tech startups and SMEs. The competitive landscape includes local players and global companies like Dell Technologies and Microsoft, all vying for market share. The local business environment is characterized by a focus on innovation and collaboration, with sectors such as retail, finance, and education leading the charge in adopting PCaaS. This trend is reshaping the IT landscape in Indonesia.

Rest of APAC : Tailored Solutions for Growth

Countries like Vietnam, Philippines, and Singapore are key markets within this sub-region, each with unique market characteristics. The competitive landscape features a mix of local players and global companies like IBM and Oracle, all vying for market share. The local business environment is characterized by a focus on innovation and collaboration, with sectors such as retail, finance, and education leading the charge in adopting PCaaS. This trend is reshaping the IT landscape across the region.