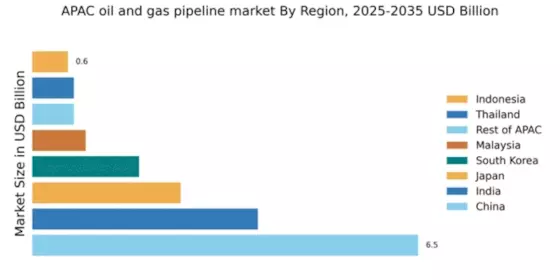

China : Unmatched Growth and Demand Trends

China holds a commanding 6.5% market share in the APAC oil gas-pipeline sector, driven by rapid industrialization and urbanization. Key growth drivers include government initiatives aimed at energy security and infrastructure development, such as the Belt and Road Initiative. Demand for natural gas is surging, supported by regulatory policies promoting cleaner energy sources. The government is investing heavily in pipeline infrastructure to meet rising consumption patterns, particularly in urban areas.

India : Rapid Growth in Energy Demand

India's oil gas-pipeline market accounts for 3.8% of the APAC total, fueled by increasing energy consumption and urbanization. The government's focus on expanding the national gas grid and promoting renewable energy sources is driving growth. Regulatory frameworks are evolving to attract foreign investment, while infrastructure projects like the Pradhan Mantri Urja Ganga are enhancing connectivity. Demand for natural gas is expected to rise significantly in the coming years.

Japan : Innovation in Energy Solutions

Japan's market share stands at 2.5%, characterized by advanced technology and a focus on energy efficiency. The country is transitioning towards cleaner energy sources, driven by regulatory policies post-Fukushima. Demand for natural gas is increasing, supported by government initiatives to diversify energy sources. Infrastructure investments are aimed at enhancing pipeline safety and efficiency, reflecting Japan's commitment to energy security and sustainability.

South Korea : Growing Demand for Natural Gas

South Korea holds a 1.8% share in the oil gas-pipeline market, with a strong focus on natural gas imports. The government's energy policies are geared towards reducing reliance on coal and increasing the share of natural gas in the energy mix. Key infrastructure projects, such as the construction of LNG terminals, are underway to support this transition. The competitive landscape includes major players like Korea Gas Corporation and SK E&S, driving innovation and efficiency.

Malaysia : Focus on Infrastructure Development

Malaysia's oil gas-pipeline market represents 0.9% of the APAC total, with growth driven by government initiatives to enhance energy infrastructure. The country is focusing on expanding its pipeline network to support domestic and regional demand. Regulatory policies are being refined to attract foreign investment, particularly in the upstream sector. The competitive landscape features key players like Petronas, which is pivotal in driving market growth and innovation.

Thailand : Evolving Energy Landscape

Thailand's market share is 0.7%, with increasing demand for natural gas as a cleaner energy alternative. The government is implementing regulatory reforms to enhance energy security and attract investment in pipeline infrastructure. Key projects, such as the Eastern Economic Corridor, are set to boost energy connectivity. The competitive landscape includes major players like PTT Public Company Limited, which is instrumental in shaping the market dynamics.

Indonesia : Focus on Energy Accessibility

Indonesia's oil gas-pipeline market accounts for 0.6% of the APAC total, with significant potential for growth driven by increasing energy demand. The government is prioritizing infrastructure development to enhance energy accessibility, particularly in remote areas. Regulatory frameworks are evolving to support investment in the energy sector. The competitive landscape includes key players like Pertamina, which is crucial for market expansion and innovation.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC holds a 0.7% market share in the oil gas-pipeline sector, characterized by diverse market conditions and regulatory environments. Growth is driven by varying demand for energy across different countries, with some focusing on renewable sources while others prioritize fossil fuels. Infrastructure development is uneven, with certain regions investing heavily in pipeline networks. The competitive landscape is fragmented, with local players dominating in specific markets.