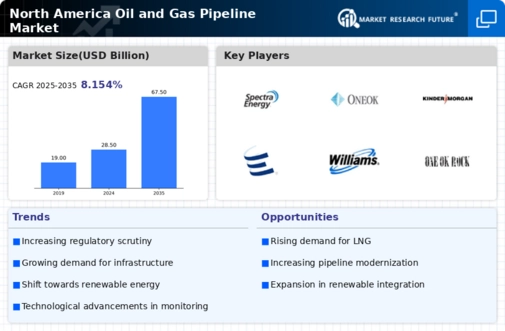

Rising Energy Demand

The oil gas-pipeline market in North America is experiencing a notable increase in energy demand, driven by population growth and industrial expansion. As urban areas continue to grow, the need for reliable energy sources becomes paramount. In 2025, energy consumption in the region is projected to rise by approximately 2.5% annually, necessitating the expansion of pipeline infrastructure to transport crude oil and natural gas efficiently. This demand is further fueled by the resurgence of manufacturing activities and the increasing reliance on natural gas for power generation. Consequently, the oil gas-pipeline market is likely to see substantial investments aimed at enhancing capacity and ensuring the delivery of energy resources to meet this growing demand.

Infrastructure Upgrades and Maintenance

The oil gas-pipeline market in North America is significantly influenced by the need for infrastructure upgrades and maintenance. Aging pipelines pose safety risks and operational inefficiencies, prompting regulatory bodies to enforce stricter safety standards. In 2025, it is estimated that over 30% of existing pipelines will require substantial upgrades to comply with new regulations. This situation creates opportunities for companies within the oil gas-pipeline market to invest in modern technologies and materials that enhance safety and efficiency. Moreover, regular maintenance activities are essential to prevent leaks and ensure the integrity of the pipeline network, thereby driving demand for specialized services and equipment.

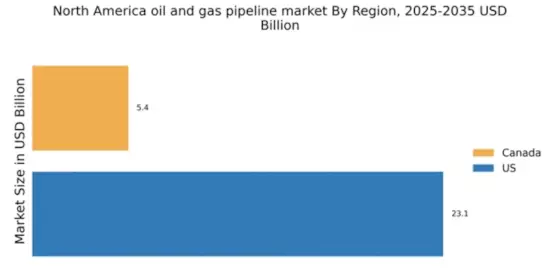

Geopolitical Factors and Energy Security

Geopolitical dynamics play a crucial role in shaping the oil gas-pipeline market in North America. The region's energy security is increasingly influenced by international relations and trade agreements. In 2025, the ongoing tensions in various oil-producing regions may lead to fluctuations in crude oil prices, prompting North American countries to bolster their domestic production capabilities. This scenario could result in increased investments in pipeline infrastructure to facilitate the transportation of locally sourced oil and gas. The oil gas-pipeline market must navigate these geopolitical challenges while ensuring a stable supply of energy resources to meet domestic needs.

Technological Innovations in Pipeline Monitoring

Technological innovations are transforming the oil gas-pipeline market in North America, particularly in the realm of pipeline monitoring and management. In 2025, advancements in sensor technologies and data analytics are expected to enhance the ability to detect leaks and monitor pipeline integrity in real-time. These innovations not only improve safety but also reduce operational costs by enabling predictive maintenance strategies. As companies within the oil gas-pipeline market adopt these technologies, they are likely to experience increased efficiency and reduced downtime, ultimately contributing to a more resilient energy infrastructure.

Environmental Regulations and Sustainability Initiatives

The oil gas-pipeline market in North America is under growing pressure to comply with stringent environmental regulations. In 2025, the implementation of new sustainability initiatives is expected to reshape operational practices within the industry. Companies are increasingly adopting eco-friendly technologies and practices to minimize their environmental footprint. This shift is likely to drive investments in pipeline systems that utilize advanced materials and monitoring technologies to reduce emissions and enhance safety. The oil gas-pipeline market must adapt to these evolving regulations while balancing the need for energy production with environmental stewardship.