Increasing Energy Demand

The rising The Oil Gas Pipeline Fabrication and Construction Industry. As economies expand and populations grow, the need for energy resources intensifies. According to recent data, energy consumption is projected to increase by approximately 30% by 2040. This surge necessitates the development of extensive pipeline networks to transport oil and gas efficiently. Consequently, investments in pipeline fabrication and construction are likely to rise, as companies seek to enhance their infrastructure to meet this demand. Furthermore, the transition towards cleaner energy sources may also require new pipelines to transport natural gas, which is seen as a bridge fuel in the energy transition. Thus, the increasing energy demand is a significant catalyst for growth in the Oil Gas Pipeline Fabrication and Construction Market.

Technological Innovations

Technological advancements are transforming the Oil Gas Pipeline Fabrication and Construction Market. Innovations such as automated welding, advanced materials, and real-time monitoring systems are enhancing the efficiency and safety of pipeline construction. For example, the adoption of robotics in welding processes can significantly reduce labor costs and improve precision. Moreover, the integration of digital technologies, such as Geographic Information Systems (GIS) and Internet of Things (IoT), allows for better planning and management of pipeline projects. These technologies not only streamline operations but also contribute to reducing environmental impacts. As companies increasingly embrace these innovations, the Oil Gas Pipeline Fabrication and Construction Market is expected to witness substantial growth, driven by enhanced operational efficiencies and reduced project timelines.

Regulatory Frameworks and Compliance

The evolving regulatory landscape plays a crucial role in shaping the Oil Gas Pipeline Fabrication and Construction Market. Governments worldwide are implementing stricter regulations to ensure environmental protection and safety in pipeline construction and operation. Compliance with these regulations often necessitates advanced fabrication techniques and materials, which can drive innovation within the industry. For instance, the introduction of new safety standards may require companies to invest in more robust pipeline designs and construction methods. Additionally, the need for compliance can lead to increased project costs, thereby influencing market dynamics. As regulations continue to evolve, companies that adapt swiftly to these changes are likely to gain a competitive edge in the Oil Gas Pipeline Fabrication and Construction Market.

Investment in Infrastructure Development

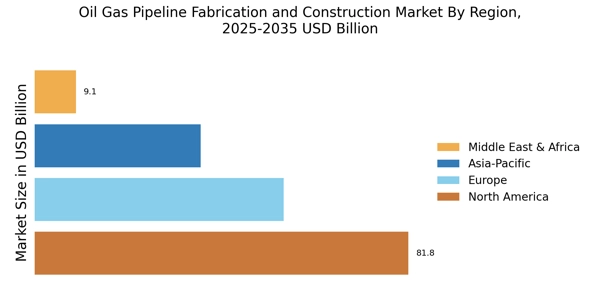

Investment in infrastructure development is a pivotal driver for the Oil Gas Pipeline Fabrication and Construction Market. Many countries are prioritizing the expansion of their energy infrastructure to support economic growth and energy security. For instance, significant investments are being made in pipeline projects to connect remote oil and gas fields to processing facilities and markets. According to industry reports, the pipeline construction sector is expected to see investments exceeding several billion dollars in the coming years. This influx of capital is likely to stimulate job creation and technological advancements within the industry. Furthermore, as nations strive to diversify their energy sources, the demand for new pipelines to transport various fuels will continue to rise, further propelling the Oil Gas Pipeline Fabrication and Construction Market.

Geopolitical Factors and Supply Chain Dynamics

Geopolitical factors significantly influence the Oil Gas Pipeline Fabrication and Construction Market. Political stability, trade agreements, and international relations can impact the feasibility and funding of pipeline projects. For instance, tensions in oil-rich regions may lead to disruptions in supply chains, prompting countries to invest in alternative pipeline routes. Additionally, the need for energy independence drives nations to develop their own pipeline infrastructure, reducing reliance on foreign sources. This geopolitical landscape creates both challenges and opportunities for the industry. Companies that can navigate these complexities and adapt to changing geopolitical conditions are likely to thrive in the Oil Gas Pipeline Fabrication and Construction Market. As such, understanding the interplay between geopolitics and market dynamics is essential for stakeholders in this sector.

Leave a Comment