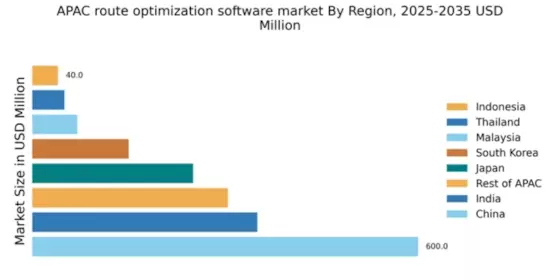

China : Unmatched Growth and Innovation

Key markets include major cities like Beijing, Shanghai, and Shenzhen, where logistics and transportation industries thrive. The competitive landscape features significant players like Trimble, HERE Technologies, and Oracle, all vying for market share. Local dynamics are characterized by a strong push for technological innovation and integration of AI in logistics. Industries such as e-commerce, manufacturing, and retail are increasingly adopting route optimization software to enhance operational efficiency and reduce costs.

India : Emerging Market with High Demand

Key markets include metropolitan areas such as Mumbai, Delhi, and Bengaluru, where logistics and transportation networks are expanding. The competitive landscape features players like SAP, Verizon Connect, and local startups. The business environment is dynamic, with increasing investments in technology and infrastructure. Industries such as retail, manufacturing, and food delivery are major adopters of route optimization software, seeking to streamline operations and improve customer satisfaction.

Japan : Focus on Efficiency and Innovation

Key markets include Tokyo, Osaka, and Nagoya, where logistics operations are highly developed. The competitive landscape features major players like Oracle and HERE Technologies, alongside local firms specializing in advanced logistics solutions. The business environment is characterized by a focus on quality and efficiency, with industries such as automotive, electronics, and retail increasingly adopting route optimization software to enhance operational performance and reduce costs.

South Korea : Strong Demand in Urban Areas

Key markets include Seoul, Busan, and Incheon, where logistics and transportation networks are well-established. The competitive landscape features players like Trimble and Samsara, competing with local firms. The business environment is dynamic, with a strong focus on technology adoption and innovation. Industries such as retail, food delivery, and manufacturing are significant users of route optimization software, seeking to improve delivery efficiency and customer satisfaction.

Malaysia : Emerging Market with Potential

Key markets include Kuala Lumpur, Penang, and Johor Bahru, where logistics operations are evolving. The competitive landscape features both international players like TomTom and local firms. The business environment is improving, with increasing investments in technology and infrastructure. Industries such as retail, manufacturing, and logistics are adopting route optimization software to streamline operations and enhance service delivery.

Thailand : Focus on Infrastructure Development

Key markets include Bangkok, Chiang Mai, and Pattaya, where logistics operations are evolving. The competitive landscape features both international players and local firms. The business environment is improving, with increasing investments in technology and infrastructure. Industries such as retail, manufacturing, and logistics are adopting route optimization software to streamline operations and enhance service delivery.

Indonesia : Focus on Urban Logistics Solutions

Key markets include Jakarta, Surabaya, and Bandung, where logistics operations are evolving. The competitive landscape features both international players and local firms. The business environment is improving, with increasing investments in technology and infrastructure. Industries such as retail, manufacturing, and logistics are adopting route optimization software to streamline operations and enhance service delivery.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include major cities in these countries, where logistics operations are evolving. The competitive landscape features both international players and local firms. The business environment varies significantly, with some countries investing heavily in technology and infrastructure while others are still developing. Industries such as retail, manufacturing, and logistics are increasingly adopting route optimization software to enhance operational efficiency and customer satisfaction.

Leave a Comment