Market Share

Introduction: Navigating the Competitive Landscape of Automotive Fuel Delivery Systems

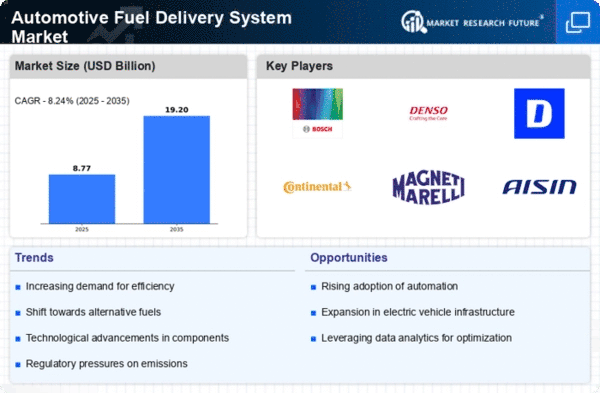

The market for fuel-delivery systems in motor cars is undergoing a revolution triggered by the fast uptake of new technology, the tightening of regulatory frameworks and the increasing demand from consumers for fuel efficiency and sustainable development. The major players, including the automobile manufacturers, the IT service providers and the fuel-station operators, are all competing to establish themselves as the leaders of the market, deploying new technology, such as artificial intelligence-based diagnostics, IoT integration and smart-station solutions. The automobile manufacturers are concentrating on reducing fuel consumption and reducing emissions, while the IT service providers are developing smart systems to optimize the fuel-delivery process. The new entrants, especially the artificial intelligence start-ups, are challenging the established order with their automation and predictive maintenance solutions. In 2024–25, the strategic deployment trends will be based on the development of a network of collaborators, with the integration of biometrics and real-time data analysis, in order to meet the next wave of consumer demand and regulatory compliance.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions encompassing various aspects of fuel delivery systems.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Continental AG | Integrated automotive technology solutions | Fuel delivery systems and components | Global |

| Robert Bosch GmbH | Innovative engineering and technology leadership | Fuel injection systems and components | Global |

| Delphi Automotive Plc. | Advanced fuel management technologies | Fuel delivery and management systems | North America, Europe, Asia |

| Denso Corporation | High-quality automotive components | Fuel injectors and delivery systems | Global |

Specialized Technology Vendors

These vendors focus on niche technologies that enhance fuel delivery efficiency and performance.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Infineon Technologies AG | Semiconductor solutions for automotive applications | Electronic control units for fuel systems | Global |

| TI Automotive INC | Expertise in fluid storage and delivery | Fuel tank and delivery systems | Global |

| NGK Spark Plug Co. Ltd | Leading spark plug technology | Ignition systems and fuel efficiency | Global |

Infrastructure & Equipment Providers

These vendors supply essential components and systems that support fuel delivery infrastructure.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Magneti Marelli | Comprehensive automotive systems expertise | Fuel delivery and exhaust systems | Global |

| UCAL Fuel Systems | Specialized in fuel system components | Carburetors and fuel pumps | India, Asia |

| Toyoda Gosei | Innovative rubber and plastic components | Fuel delivery hoses and systems | Global |

Emerging Players & Regional Champions

- Aptiv (USA): Specializes in advanced fuel delivery systems with integrated electronic controls, recently partnered with a major OEM for a new electric vehicle platform, challenging traditional mechanical fuel delivery systems.

- Continental AG (Germany): Offers innovative fuel pump technologies and smart fuel management systems, recently secured a contract with a European automaker for next-gen fuel systems, complementing established players by enhancing efficiency.

- Denso Corporation (Japan): Focuses on high-performance fuel injectors and delivery systems, recently implemented a project with a leading hybrid vehicle manufacturer, positioning itself as a strong competitor to legacy suppliers.

- Magneti Marelli (Italy): Provides modular fuel delivery solutions tailored for electric and hybrid vehicles, recently expanded its footprint in the Asian market, challenging established vendors by offering flexible and scalable solutions.

Regional Trends: In 2023, the automobile fuel-delivery systems market is undergoing a marked shift towards electrification and hybridization, especially in Europe and Asia. In this market, digital technology and smart systems are increasingly being integrated in order to improve fuel economy and reduce emissions. The trend is towards solutions that are more adaptable and more flexible to cope with the diverse range of vehicles, including hybrid and electric vehicles. The development of such solutions is fostering innovation and competition among both new and established players.

Collaborations & M&A Movements

- Continental AG and Bosch entered into a partnership to develop advanced fuel delivery systems aimed at improving fuel efficiency and reducing emissions in compliance with upcoming EU regulations.

- Denso Corporation acquired a 30% stake in a startup specializing in electric fuel delivery technologies to enhance its portfolio in the growing electric vehicle market.

- Magna International and Ford Motor Company collaborated to innovate fuel delivery systems that support the transition to hybrid and electric vehicles, strengthening their competitive positioning in the evolving automotive landscape.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Fuel Efficiency Optimization | Bosch, Denso | Then he went on to say that the Bosch company had introduced new fuel injection systems which had increased the efficiency of fuel consumption by up to fifteen per cent, while Denso’s fuel injection and injection-control systems were reducing exhaust emissions and increasing the performance of vehicles. |

| Integration with Electric Vehicles (EVs) | Continental, Magna International | Continental has developed hybrid fuel systems which are completely compatible with electric drive trains and thus demonstrate their versatility in the constantly changing market. Magna International's focus on its system-modular approach makes it easy to integrate its systems into various EV platforms and thus increases its market appeal. |

| Advanced Materials for Durability | Delphi Technologies, Aptiv | The Delphi fuel-delivery system is made of high-performance polymers that are resistant to extreme conditions, and have been tested under these conditions. These materials are not only lightweight but also very durable. |

| Smart Fuel Management Systems | Siemens, Honeywell | It is well known that the more intelligent the means of control, the more efficient the resultant work. |

| Sustainability Initiatives | Ford Motor Company, Toyota | The Ford Motor Company is putting its energy resources to use in the field of sustainable transport, and has invested in the fields of hydrogen and biofuels as part of its wider strategy of sustainable development. Similarly, the Japanese automobile manufacturer Toyota is developing eco-friendly fuel systems to go with its hybrid and hydrogen vehicles. |

Conclusion: Navigating Competitive Waters in Fuel Delivery

The world market for fuel delivery in automobiles will be characterized by intense competition and fragmentation. Both the established and the newcomers will compete for a share of the market. The regional trends will be directed towards greater emphasis on the development of sustainable and advanced technology, and the suppliers will be forced to adopt their strategies accordingly. The established suppliers will use their established networks and experience to ensure that they have a presence in the market. The newcomers will focus on innovation in artificial intelligence, automation and the development of new flexible solutions that meet the changing needs of the consumers. As the market develops, the companies that can demonstrate their superiority in terms of sustainable and flexible operation will be the ones who survive and thrive in the rapidly changing environment. To ensure a competitive advantage, the decision-makers must focus their investments in these areas.

Leave a Comment